Achieving true omnichannel is not easy, experts say. But these technologies justify themselves

Digital technology has changed how many sectors work. Banking is no exception. Today banks provide services through both physical and digital channels: branches, ATMs, call centers, Internet banking and mobile communications. However, it is thanks to their integration and coherence, that is, omnichannel, that a better level of interaction can be achieved.

However, for many financial institutions, offering this experience is a real challenge. Indeed, for this they need to organize the interaction of dozens of heterogeneous systems created by different parties on different platforms (for example, a switch, a card management system, CRM, ACS, etc.). In these conditions, the implementation of a multichannel service turns into a very complex project from both a technical and organizational point of view.

According to Kaptsan, it is especially difficult and often almost impossible to solve this problem for financial companies, whose information systems are built around basic systems that are more than twenty years old - which, unfortunately, is often found on the market.

Therefore, it is important that the technology infrastructure is built on solutions that can operate in a modern, dynamic environment.

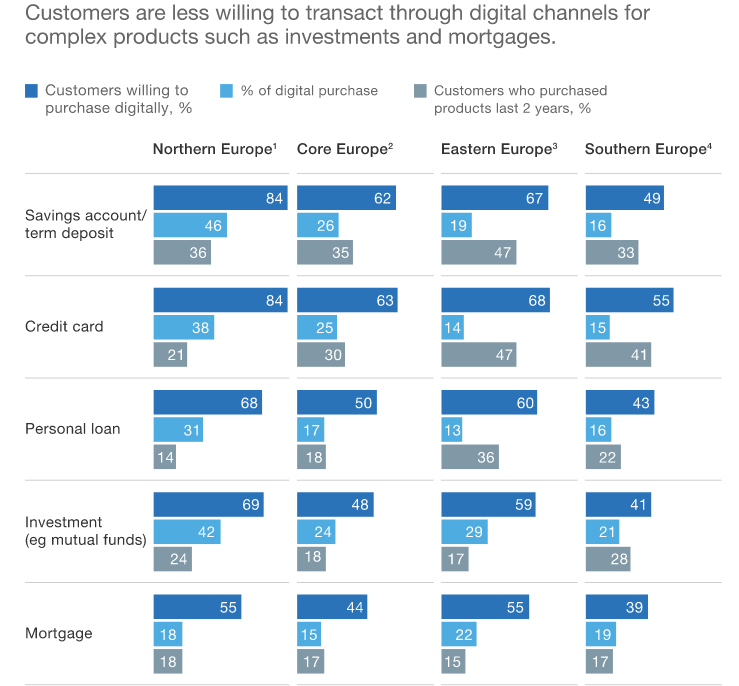

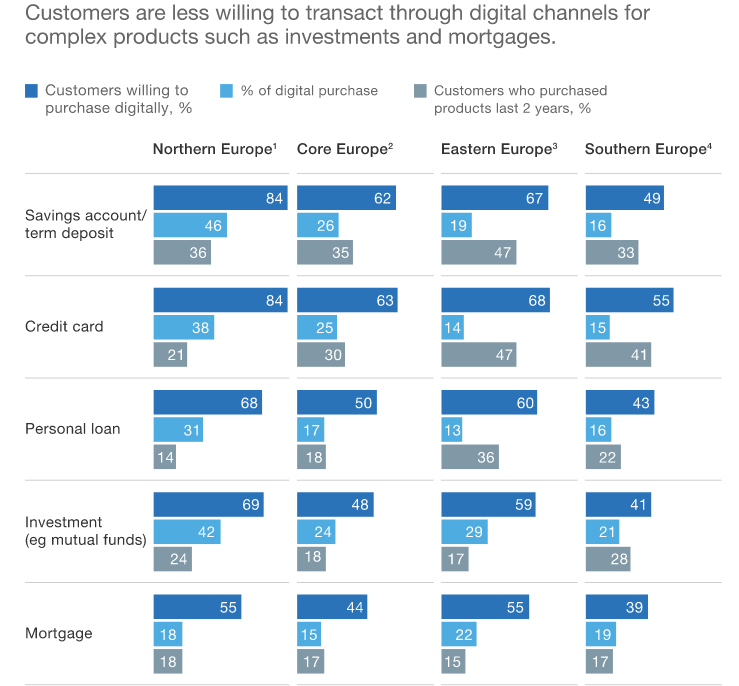

Digital enthusiasm is market dependent. Thus, customers of southern European banks are less inclined to receive simpler products via the Internet or a smartphone. Photo: www.mckinsey.com.

Thus, in order to achieve omnichannel, banks must "tighten up" some processes:

In addition, nonlinear machine learning algorithms can quickly improve model prediction. Many banks have been able to triple their sales campaign conversion rates after updating their models and integrating high-frequency variables and triggers from real-time behavior into traditional static customer profiles.

Digital technology has changed how many sectors work. Banking is no exception. Today banks provide services through both physical and digital channels: branches, ATMs, call centers, Internet banking and mobile communications. However, it is thanks to their integration and coherence, that is, omnichannel, that a better level of interaction can be achieved.

What is omnichannel in the banking world?

Omnichannel is the ability to seamlessly switch between different communication channels (SMS, mail, chats, messenger, voice) and the formation of a single history of requests for a particular client. In other words, it is the perfect buffer between online banking and a physical branch. A true omnichannel banking platform is ensured by real-time data synchronization across all channels. For example, users can start the communication process on one channel and end on another, without having to re-provide the original data. The main feature of omnichannel is the well-coordinated work of all channels.The key advantages of an omnichannel bank are:

- Fast and effective problem solving. Interaction on the Internet avoids a number of unnecessary steps, such as the opening conversation, which is an integral part of offline communication. On the Internet, you can get to the point much faster. Therefore, banks can save on customer support costs.

- Personalization. Omnichannel makes it possible to offer the client a solution to his particular problem. Thus, his loyalty increases.

How banks can become a true omnichannel platform

Anatoly Kaptsan, Vice President and Head of Research and Development at Compass Plus, noted in his blog that a real banking omnichannel is now a rare phenomenon. He gives an example of such a perfect experience in a situation where a client lost his card on vacation. First of all - he contacted his bank via the customer service center or online chat to report it. In the conditions of flawless operation of all channels, the client will block all his cards, in a matter of minutes he will receive a new virtual card directly into his wallet (Apple Pay, etc.), as well as a new physical card that will be waiting for him upon returning home.However, for many financial institutions, offering this experience is a real challenge. Indeed, for this they need to organize the interaction of dozens of heterogeneous systems created by different parties on different platforms (for example, a switch, a card management system, CRM, ACS, etc.). In these conditions, the implementation of a multichannel service turns into a very complex project from both a technical and organizational point of view.

According to Kaptsan, it is especially difficult and often almost impossible to solve this problem for financial companies, whose information systems are built around basic systems that are more than twenty years old - which, unfortunately, is often found on the market.

Therefore, it is important that the technology infrastructure is built on solutions that can operate in a modern, dynamic environment.

Digital enthusiasm is market dependent. Thus, customers of southern European banks are less inclined to receive simpler products via the Internet or a smartphone. Photo: www.mckinsey.com.

Thus, in order to achieve omnichannel, banks must "tighten up" some processes:

- Introduce advanced analytics

In addition, nonlinear machine learning algorithms can quickly improve model prediction. Many banks have been able to triple their sales campaign conversion rates after updating their models and integrating high-frequency variables and triggers from real-time behavior into traditional static customer profiles.

- Personalize marketing across different channels

- Motivate the sales team