What the study is about

Other parts of the study

We present to your attention the results of a study on ensuring information security of one of the most vulnerable areas of the bank — the process of making non-cash payments.

The study turned out to be quite extensive, so it will be published in parts. And we will start with the first part, which will tell you what non-cash payments are from an economic point of view.

Terms, definitions, assumptions and conventions

The purpose of the study is to systematize knowledge, solutions and experience in ensuring information security of bank wire transfers.

Information sources:

Assumptions:

The standard scheme of organizational and technical interaction between credit institutions and the Bank of Russia adopted in the Moscow region is taken as a basis.

When considering the economic fundamentals, issues related to the collection of commissions and accounting will be omitted.

Terms and conditions:

The study will use terms and definitions in the sense in which they are used in the current legislation of the Russian Federation.

Synonyms:

Bank = credit institution.

Non-cash payment = transfer of funds.

Payments = settlements.

Historically, the first types of payments were made in cash. The buyer handed over banknotes to the seller, and in return received a product or service.

Let's analyze the pros and cons of this form of settlement from the point of view of the buyer and seller, as well as from the point of view of the state economy as a whole.

Thus, it is clear that cash payments for the state are an evil that it would gladly prohibit if it did not cause a sharp protest of the population. And if it is impossible to completely ban it, then restrictive measures are applied.

In Russia, in particular, legislation (Civil Code of the Russian Federation, Article 861, Bank of Russia Directive 3073-U of 07.10.2013) establishes that only citizens and only for personal purposes can use cash without restrictions, while the rest (sole proprietors, legal entities,...) are strictly limited in the use of cash.

Non-cash payments, in contrast to cash payments, imply the presence of a third trusted party between the seller and the buyer — an intermediary who, on behalf of the parties, performs settlements between them.

Cryptocurrencies such as Bitcoin, Ethereum, and others allow payments to be made without intermediaries (not counting miners), but so far the status of these systems is not legally defined, and their description is beyond the scope of this article. Here we will consider only "classic" non-cash payments, where credit organizations (banks) act as the third trusted party.

For making non-cash payments, money is used in a non-cash form. Consider the mechanisms for converting money from cash to non-cash and back.

It all starts with the fact that the client, whether an individual, a legal entity or an individual entrepreneur, enters into a contractual relationship with a credit institution that has a banking license from the Bank of Russia.

The Client transfers cash funds to the bank, the bank accepts them and reflects them on a bank account specially established for accounting for settlements with the client. If the client deposits money in the bank, the balance on this account increases, if he withdraws, it decreases.

After the client has deposited cash in the bank, it turns into non-cash money, which, if much simplified, is not even money, but the bank's obligations to do certain services for the client, which can include issuing cash to the client, transferring funds, and so on.

In addition to receiving and withdrawing cash, the client's bank account may increase or decrease due to receiving non-cash transfers from third parties and making transfers to third parties, respectively. It is important to note that non-cash money is not the obligations of the entire banking system, but the obligations of the bank where the corresponding bank account is opened. This realization comes especially vividly if the bank that serves this account goes bankrupt. Then the money (the balance on the account) seems to be there, but it is impossible to use it.

There are different types of bank accounts. Customers — individuals-open current or special card accounts with the bank. Clients — legal entities-open current accounts with banks. Banks open correspondent accounts with other banks to make payments. Without going into details, the functioning of all these accounts looks approximately the same: an increase in the account balance leads to an increase in the obligations of the bank in which it is opened, and vice versa, a decrease in the balance reduces the bank's obligations. For the sake of simplicity, in the future we will consider only work on settlement and correspondent accounts.

At this stage, the bank will consist of two main parts for us:

One of the main sources of income for banks is lending. The bank transfers the money for temporary use to the client, who returns it with interest. To support this type of business, the bank needs money that it will give on credit. And this is where customer money stored in non-cash accounts comes into play.

The basic idea is that the bank never holds all the money of its customers. Instead, the bank keeps statistical records of customers ' activities and "very accurately guesses" how much money they may need for current payments. The rest of the money is used by the bank for lending.

Let's look at how a non-cash payment is made between a payer and a recipient (hereinafter referred to as clients) who are served in the same bank.

When paying in cash, payments are always of the same type: the payer voluntarily transfers the required amount of money to the recipient. When using non-cash payments, the payment schemes may be different:

The most common form of settlement is based on payment orders.

Regardless of the settlement forms used, the Bank reports to the client for all transactions made on its account by providing a special document – an account statement.

The payment order and account statement are the main legally significant documents used by the client and the bank for accounting purposes and conflict resolution proceedings in court.

It is important to note that if a payment was received to the client's current account and it was reflected in the account statement, the bank does not have the right to return the payment to the sender, even if it was made by mistake or maliciously. Refund of payment is possible only by agreement with the recipient or by a court decision. The maximum that a bank can do is, in accordance with the legislation on countering the legalization of proceeds from crime, to block funds in the recipient's account.

Note

The Civil Code of the Russian Federation (Civil Code of the Russian Federation Article 1102. Obligation to return unjust enrichment) requires the recipient to return funds to the sender if they were sent without justification or by mistake.

Earlier, we looked at how transfers are made between clients served in the same bank. Now let's complicate the task and look at how settlements are made between clients served in two different banks.

For interbank settlements, banks must establish correspondent relations with each other. The essence of this relationship is that one bank, Bank 2 in the diagram below (Figure 3), becomes a client of Bank 1 and opens a special bank account called a correspondent account. After opening a correspondent account, Bank 2 deposits a certain amount of money into it, a kind of monetary buffer in the amount of which Bank 2's clients can send payments to Bank 1's clients.

To understand how this works, let's look at an example. Let's say that Bank 2 has placed, say, 1 million rubles on a correspondent account in Bank 1.

The mechanism for making payments between two banks, which we just reviewed, is simple, but has a significant drawback in terms of scalability. With a large number of banks, it is difficult to establish and maintain correspondent relations between each bank and each other. Therefore, the main tool for interbank money transfers in the Russian Federation is the payment system of the Bank of Russia.

The main idea of this payment system is that the Bank of Russia acts as a single point to which all banks are connected, and through which payments pass from one bank to another.

Each credit institution, when registering and obtaining a banking license, opens a correspondent account with the Bank of Russia.

In order to be able to distinguish one bank from another, they are assigned bank identification codes (BIC). The Bank of Russia regularly updates and publishes the BIC directory on its website. If you know the BIC, you can also use this directory to determine the corresponding bank account number opened with the Bank of Russia. The combination of the BIC and current account number uniquely identifies the client's current account within the entire payment system of the Russian Federation.

Let's look at how an interbank payment will be made using the Bank of Russia's payment system. Let's take the interaction between customers and banks as a basis, illustrated in Figure 4.

If there are several options for the flow of funds, as, for example, between Client B and Client C in Figure 4, the sending bank independently decides on the routing of the payment: using direct correspondent relations or through the payment system of the Bank of Russia-depending on the payment parameters, its cost price and other conditions.

Money transfers in the payment system of the Bank of Russia are carried out:

Real-time payment processing is similar to using a taxi. The payment is sent to the Bank of Russia and processed immediately. In discrete mode, payment processing is similar to transporting passengers by regular bus. Payments are first accumulated, and then all of them are processed in a heap. The Bank of Russia operates several similar flights during the business day.

The schedule of flights accepted in the Moscow region is published on the website of the Bank of Russia and consists of five flights:

The Bank of Russia's tariffs for making payments via BESP are higher than in discrete mode.

Before that, we discussed how banks execute customer payments. Now let's look at how the bank makes its own payments, for example, buying paper, paying for electricity, communication services, etc.

By and large, everything is done exactly the same as in the case of customer payments, only the bank pays not from the current account, but from one of its correspondent accounts. This circumstance often puts inexperienced counterparties of the bank in a stupor, and they compulsively demand the bank's current account number, while banks usually do not have current accounts. Otherwise, everything is the same: a payment order is generated, then it is sent to the bank where the corresponding account is opened, that bank executes it and responds with an account statement.

In the 90-x years of the last century, the term "automated system" was often used in the state standards and regulatory documents of the FSTEC of Russia (then still the State Technical Commission under the President of the Russian Federation). "GOST 34.003-90 Information technology (IT). A set of standards for automated systems. Automated systems. Terms and Definitions " gives the following definition of this term:

After some time, a new term came into use — information system. In clause 3 of Article 2 of Federal Law No. 149-FZ of 27.07.2006 "On Information, Information Technologies and Information Protection", this term is defined as follows::

In this study, both terms will be used interchangeably.

The validity of this approach can be proved by the fact that in the Order of the FSTEC of Russia dated 11.02.2013 N 17 "On approval of Requirements for the protection of Information that does not Constitute a state secret contained in state information systems", the state regulator prescribes to be guided by State Standards on automated systems for the protection of information systems.

In addition to information systems, the bank's IT infrastructure also includes one more type of elements — information services, or, as they are often called, robots.

It is rather difficult to define the concept of an information service, so let's just list its main differences from an information system:

The core of any bank's information infrastructure is an automated banking system, or ABS for short.

Standard of the Bank of Russia STO BR IBBS-1.0-2014 " Ensuring information security of organizations of the banking system of the Russian Federation. General Provisions" defines ABS as follows:

This definition allows you to fit almost any IT system in a bank under it. At the same time, ordinary bank employees call ABS the system that deals with accounting for bank accounts, transactions between them (cash flow) and balances. The second definition does not contradict the first one and details it more clearly, and we will continue to use it.

In modern Russian banks, the most common ABS are the following:

Some particularly large banks do not use mass-produced ABS systems, but specially designed for them. But such cases are rare, just like especially large banks.

Sometimes banks use several ABS systems from different manufacturers in parallel. This often happens when a bank tries to switch from one ABS to another, but there may be less trivial reasons.

Despite the fact that ABS automates quite a large number of tasks, it does not cover all the bank's needs. There are tasks that the ABS does not do at all or does not do as the bank wants it to do. Therefore, other information systems that automate individual business processes are connected (integrated) to the ABS. In the future, such information systems will be called applied information systems.

Examples of applied information systems include:

Depending on the size of the bank and the services it provides, the number of applied information systems can range from units to hundreds.

In addition to ABS and applied information systems that automate basic business processes, banks also have a decent number of auxiliary infrastructure information systems. Examples of such systems can be:

Banks use a huge number of different information services that perform simple, routine functions, such as downloading BIC and FIAS reference books, publishing currency rates on the official website, etc.

Special mention should be made of the client parts of information systems external to the bank. As examples, I will give:

The following mechanisms are usually used to integrate information systems:

Under the integration module, we will understand a virtual element of the IT infrastructure that implements the integration of other elements of the IT infrastructure.

We called this element virtual, because its functionality can be implemented either as a separate specialized element of the IT infrastructure (for example, an information service), or as components of integrated information systems. Moreover, even a person who "manually" transfers information between integrated information systems can act as an integration module.

Shows a fragment of a typical bank information infrastructure containing the types of elements discussed above.

If you look at this scheme from the point of view of performing non-cash payments, you can see that the bank implements them using:

Technically, direct correspondent relations with partner banks can be organized using:

Connection to payment systems that serve plastic cards is made through standard modules that are part of processing systems.

For successful operation, the bank must ensure information security of all listed payment methods. It is very problematic to consider them within the framework of a single, even large-scale study, and therefore we will focus only on one area that is most critical from the point of view of possible losses — the bank's payment interaction with the Bank of Russia.

We will consider the IT infrastructure of the bank's payment interaction with the Bank of Russia as an example of the execution of a payment sent to a client of another bank.

As we remember from the first part, the client must first send a payment order to the bank. There are two ways to do this:

It is important to note here that RBS systems are only systems that provide legally significant electronic document flow between the client and the bank, and they do not make payments independently. That is why when a client opens a bank account, they usually enter into two contracts. The first is a contract for servicing a bank account, the second is a contract for electronic document management using the RBS ICB system. If the second agreement is not concluded, the client will still be able to use their account, but only during a personal visit to the bank's branch.

If the client has submitted a payment order in hard copy, the bank employee makes an electronic payment order based on it to the ABS. If the order was submitted via the RBS of the ICB, then it is automatically sent to the ABS via the integration module.

Proof that it was the client who made the order to transfer funds, in the first case, is a paper document personally signed by him, and in the second, an electronic document in the RBS of the ICB, certified in accordance with the agreement.

Usually, for certification of electronic documents of clients — legal entities, RBS ICB uses a cryptographic electronic signature, and for documents of clients — individuals, SMS confirmation codes are used. From a legal point of view, banks usually use the legal regime of a handwritten signature analog (TSA) to certify electronic documents in both cases.

Once in the ABS, the payment order is monitored in accordance with the bank's internal regulations and sent for execution to the Bank of Russia's payment system.

The technical means (software) used to interact with the Bank of Russia payment system may vary depending on the territorial institution of the Bank of Russia that serves the bank's correspondent account.

For banks served in the Moscow region, the following software applies:

APM KBR is software used by authorized employees of the bank to encrypt and electronically sign outgoing payment documents, as well as decrypt and verify the electronic signature of payment documents received from the Bank of Russia. But, to be more precise, the KBR Automated Control System operates not with payment documents, but with electronic messages (ES), which are of two types:

The list and formats of electronic messages are established by the Bank of Russia by issuing an Album of Unified Formats of Electronic Banking Messages (UFEBS).

In order for the KBR AWP to process the payment, it must be converted to a file containing an electronic payment message in the UFEBS format. The ABS integration module with the Bank of Russia payment system is responsible for this transformation. From a technical point of view, such conversions are quite simple, since the UFEBS format is based on XML.

Files of electronic messages leave the ABS integration module in open format and are placed in a special folder of the file system (usually a network folder), which is configured in the KBR WORKSTATION for electronic messages with the status "Entered". In the previous diagram, this folder is designated as "Folder 1".

Then, during processing, electronic messages change their statuses to "Controlled", "Sent" , etc., which is technically implemented by moving the file with the electronic message to the corresponding folders that are configured in the KBR AWP. In the diagram (Fig. 2), these folders are designated as "Folder 2".

At a certain moment of technological processing (established by the bank's internal regulations) of outgoing electronic messages, they are encrypted and signed with an electronic signature using SCAD Signature and private cryptographic keys of responsible employees.

SCAD Signature is a SCSI developed by Validata LLC on behalf of the Bank of Russia and designed to protect information in the Bank of Russia's payment system. This SCSI is not publicly available (except for the documentation posted on the CBR website), and it is distributed by the Bank of Russia only to participants of its payment system. The distinctive features of this SCSI include::

Encrypted and signed electronic messages are placed in a special folder, in the diagram this is "Folder 3". UTA continuously monitors this folder and, if it sees new files there, transmits them to the Central Bank of the Russian Federation in one of the following ways:

After reaching out to the Central Bank (in the first or second way), UTA transmits electronic messages through the API published by the Central Bank. During communication sessions, UTA also receives input electronic messages from the Central Bank.

It should be noted that all electronic messages that UTA works with are encrypted and signed with an electronic signature.

After receiving an encrypted email, UTA moves it to the folder with incoming encrypted messages. The authorized employee checks the electronic signature and decrypts the message with the help of their cryptographic keys and APM KBR.

Further processing is performed depending on the type of electronic message. If this is a payment message, it is transmitted to the ABS via the integration module, where accounting entries are generated based on it, which change the account balances. It is important to note that when the ABS (integration module) interacts with the KBR AWP, standard format files are used in open format.

During the operation of the automated control system, the KBR keeps a log of its work, which can be implemented in the form of text files or using databases running under the DBMS.

We have considered the "classic" scheme of the system operation. In reality, there are many varieties of it. Let's look at some of them.

Type 1. Separating message sending and receiving paths

The scheme is implemented with two AWP KBR. The first one works with human participation and performs only sending messages, the second one works in automatic mode and performs only receiving messages.

AWP KBR

Version 2. The full automatic is configured to work completely in automatic mode without human intervention

APM KBR

Version 3. Isolated APM KBR functions as a dedicated computer that is not connected to the bank's network. Electronic messages are transmitted to it by a human operator using OMNI.

The Bank of Russia plans to switch to a new technological payment processing scheme, in which electronic messages will be signed not in the KBR AWP, as was previously the case, but in the ABS (more precisely, in the ABS — KBR AWP integration module).

To implement this approach, a new version of the KBR AWP was released, which became known as the KBR-N AWP (new). All the main changes can be seen if you compare the schemes of information flows passing through the AWP of the CBD of the old and new versions.

Let's consider the scheme of information flows in the classic AWP KBR. The source of the scheme is the official documentation for the KBR AUTOMATED WORKSTATION " AUTOMATED WORKPLACE OF a BANK OF RUSSIA CLIENT. Programmer's guide. CBRF.61209-04 33 01".

Notes.

Now let's take a look at a similar scheme for the new KBR-N AWP. Source " AUTOMATED WORKPLACE OF A BANK OF RUSSIA CLIENT NEW. Programmer's guide. CBRF.61289-01 33 01"

From the cryptographic point of view, the KBR-N automated workplace is responsible for encrypting / decrypting electronic messages, as well as for verifying electronic signatures on them. Electronic signature generation has been moved to the ABS integration module.

It is logical to assume that this module will also have to check signatures for messages received from the KBR-N AWP. From a technical point of view, this is not mandatory, but from a security point of view, it is critical, since it ensures the integrity of messages transmitted between the ABS and the KBR-N AWP.

In addition to the file interface for interaction between the ABS, the KBR-N automated workstation and the UTA, the IBM WebSphere MQ interface has been added, which allows you to build a service-oriented IT infrastructure of the bank and solve the problem of the old scheme with the organization of simultaneous work of several operators responsible for sending payments.

Next, we'll look at:

In the modern Russian economic environment, there are many different types of organizations. These can be state-owned enterprises( FSUE, Municipal Unitary enterprise), public funds, and, finally, ordinary commercial organizations. The main difference between the latter and all others is that their main goal is to maximize profit, and everything they do is aimed at this.

A commercial organization can earn money in various ways, but the profit is always determined in the same way – it is income minus expenses. At the same time, if security is not the main activity of the company, then it does not generate revenue, and if so, then in order for this activity to make sense, it must reduce costs.

The economic effect of ensuring business security is to minimize or completely eliminate losses from threats. However, it should also be taken into account that implementing security measures also costs money, and therefore the true profit from security will be equal to the amount saved from implementing security threats, reduced by the cost of security measures.

One day, a conversation took place between the owner of a commercial bank and the head of the security service of his organization on the topic of the economic effect of security. The essence of this conversation most accurately reflects the role and place of security in the life of the organization:

- Security should not interfere with business.

— But you have to pay for security, and you have to pay for the lack of it.

The ideal security system is the golden mean between neutralized threats, resources spent on it, and business profitability.

The reasons for creating a SIB may vary. Let's highlight two main ones:

In relation to credit institutions, the need for the existence of an SIB is fixed in the following documents:

The functionality required from SIB is spelled out in the above-mentioned documents. The staff size is not strictly regulated, with the exception, perhaps, of the license requirements of the Federal Security Service of Russia for cryptography (at least 2 employees, but they may be in different divisions) and can be selected by the organization independently. To justify the size of the staff, it is recommended to use the document-Recommendations in the field of standardization of the Bank of Russia " Ensuring information security of organizations of the banking system of the Russian Federation. Resource support of information security "RS BR IBBS-2.7-2015"

From the point of view of the SIB's subordination, there is only one restriction prescribed in the above — mentioned provisions of the Central Bank of the Russian Federation - "The Information Security Service and the informatization (automation) service should not have a common supervisor", otherwise the organization remains free to choose. Let's consider typical options.

Table 1.

When interacting with other structural divisions and top management of the bank, the SIB of any organization has one common problem — proof of the need for its existence (financing).

The problem is that the amount of money saved from neutralized information security threats cannot be accurately determined. If the threat is not realized, then there is no damage from it, and if there are no problems, then there is no need to solve them.

To solve this problem, the SIB can act in two ways:

We will highlight the practical aspects of security that must be communicated to top management and other structural divisions, as well as taken into account when building an information security system:

Summing up the intermediate result of the above, we note that the created system of information security of non-cash payments should have a practical focus and be cost-effective. The best way to achieve these properties is to apply a risk-based approach.

Information security is just one of the areas of ensuring security (economic security, physical security, fire safety,...). In addition to information security threats, any organization is subject to other equally important threats, such as threats of theft, fires, fraud by unscrupulous customers, threats of violation of mandatory requirements (compliance), etc. etc.

Ultimately, an organization doesn't care what specific threat it suffers losses from, whether it's theft, fire, or computer hacking. The amount of losses (damage) is important.

In addition to the amount of damage, an important factor in assessing threats is the probability of their implementation, which depends on the specifics of the organization's business processes, its infrastructure, external malicious factors, and the countermeasures taken.

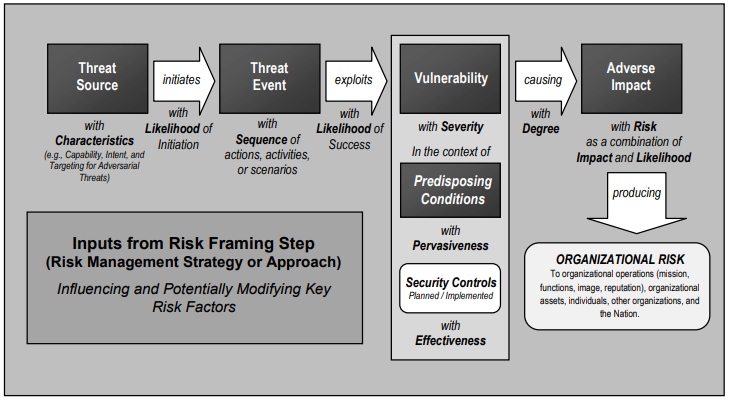

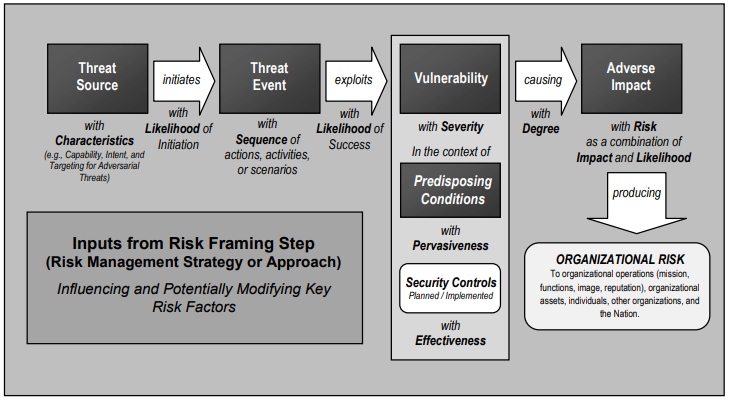

The characteristic that takes into account the damage and the probability of the threat being realized is called risk.

Note. A scientific definition of risk can be obtained in GOST R 51897-2011

Risk can be measured both quantitatively, for example, by multiplying damage by probability, and qualitatively. A qualitative assessment is made when neither the damage nor the probability is quantified. The risk in this case can be expressed as a set of values, for example, damage — "medium", probability - "high".

Assessing all threats as risks allows an organization to effectively use its available resources to neutralize exactly those threats that are most significant and dangerous for it.

Risk management is the main approach to building a comprehensive, cost-effective security system for an organization. Moreover, almost all banking regulations are based on the risk management recommendations of the Basel Committee on Banking Supervision.

We will highlight the main threats inherent in the activities of making bank non-cash payments, and determine the maximum possible damage from their implementation.

Table 2.

Here, the analyzed activity includes a set of business processes:

In the future, we will only consider issues related to ensuring the security of correspondent relations with the Bank of Russia. Nevertheless, the obtained results can be used to ensure security and other types of calculations.

When considering the main threats, we estimated their damage, but did not estimate the probability of their implementation. The fact is that if the maximum possible damage is the same for all banks, then the probability of implementing threats will differ from bank to bank and depend on the applied protective measures.

One of the main measures to reduce the likelihood of information security threats will be:

We will not talk about IT practices here, we will only touch on information security issues.

The main nuance that needs to be taken into account in ensuring information security is that this type of activity is rather tightly regulated by the state and the Central Bank. No matter how the risks are assessed, no matter how small the resources available to the bank, its protection must meet the established requirements. Otherwise, it will not be able to work.

Consider the information security requirements imposed on the business process of correspondent relations with the Bank of Russia.

Table 3.

We will also outline additional requirements for the organization of information security. These requirements will apply only to some banks and only in some cases:

The final results of applying all these requirements should be an information security system that meets any of the listed documents. In order to create such a system, requirements are summarized in a single table and in cases where there are several similar requirements, the most stringent ones are selected.

There is an important caveat here: the requirements set out in regulatory documents, as a rule, do not contain strict specifics. They indicate what the security system should look like, what tools it should consist of, and what tactical characteristics it should have. An exception will be requirements that come from the operational documentation for the information security tools used, for example, for the SCAD Signature SCSI.

Consider, for example, a fragment of the requirements of FSTEC Order No. 21

As we can see, the requirements of AVZ.1 and AVZ.2 indicate that there should be anti-virus protection. These requirements do not regulate exactly how to configure it, on which network nodes to install it (the Letter of the Bank of Russia dated 24.03.2014 N 49-T recommends that banks have antivirus products from various manufacturers on their ARMas, servers, and gateways).

The situation is similar with computer network segmentation-a VMS requirement.17. The document only prescribes the need to use this practice for protection, but does not say how the organization should do this.

You can find out exactly how information security tools are configured and how security mechanisms are implemented from a private technical specification for an information security system formed based on the results of modeling information security threats.

Thus, a comprehensive information security system should be a set of protective business processes (controls in the English – language literature), built taking into account the implementation of mandatory requirements, current threats, and information security practices.

To form a high-quality threat model, it is necessary to take into account existing practices and practices on this issue.

In this article, we will conduct a rapid review of about 40 sources describing the processes of threat modeling and information security risk management. We will consider both state standards and documents of Russian regulators (FSTEC of Russia, FSB of Russia, Central Bank of Russia), as well as international practices.

The end result of the threat modeling process should be a document-a threat model containing a list of significant (relevant) information security threats for the protected object.

When modeling threats, protected objects are usually considered as protected objects.:

By and large, the threat model does not need to be presented in the form of a list. It can be a tree (graph), a mind map, or any other form of recording that allows specialists to work with it conveniently.

The specific composition of threats will depend on the properties of the protected object and the business processes implemented using it. Accordingly, one of the source data for modeling will be a description of the protected object itself.

If a certain hypothetical object is considered, then a typical (basic) threat model is formed. If a real object is considered, then a private threat model is formed.

When modeling threats, in addition to describing the protected object, specialists must have knowledge about the threats themselves.

In practice, this knowledge can be gleaned from:

The initial stage of the modeling process will be threat identification, i.e. selecting the largest possible list of threats that can at least theoretically affect the protected object.

When implementing this stage, nature plays a cruel joke with information security specialists. The problem is that human memory is associative, and we can not take and extract all the contents from it, for example, to remember all possible threats.

In order to create a list of all possible threats, various tricks are used that allow specialists to ask themselves certain questions or use the principles by which threats will be extracted from memory and recorded. Examples of such techniques can include threat classifiers, threat trees, or patterns of typical computer attacks. We'll talk about these methods below.

Once the list of all possible threats is formed, it is filtered so that only threats that are relevant to the organization are left in the end. The filtering process is usually performed in several iterations, each of which discards threats based on one or another feature.

They start with a sign indicating that violators have the capabilities (resources) to implement threats. To determine it, first create a special document-a model of the violator, in which possible violators are identified and their capabilities are determined. Then they correlate the previously received threats with the intruder's model and discard all threats that are beyond the capabilities of potential intruders.

The next sign for filtering threats is the sign that the risk is insignificant. First, the organization determines the level of risk that it considers insignificant. Then it evaluates the risk from the implementation of each threat and, if it is less than or equal to this level, the threat is discarded.

Thus, after filtering is completed, a threat model will be obtained that contains information security threats that are significant (relevant) for the organization.

Take, for example, the problem of modeling threats to the security of personal data (PD) processed in personal data information systems (ISPDn).

The FSTEC of Russia in 2008 issued a methodological document for this purpose – the Basic Model of PD threats This document contains many classification schemes, of which we will consider the only one as an example — the classification of threats by "source of threat".

A specialist building a private threat model can use this scheme, ask yourself the question: "What threats to personal data will come from the actions of an internal intruder?" and record these threats. Then ask the following question: "How can an external intruder attack personal data?" and so on. Such a series of questions allows the specialist to describe all the threats known to him, without forgetting anything.

At the beginning, a high-level threat is formulated, which will be the root of the future tree.

Then the specialist begins to decompose this threat into low-level ones, the implementation of which can lead to the implementation of the threat in question. To do this, they may ask questions about how or how the threat under investigation can be implemented.

The threats received in this case are children of the one under consideration and are recorded in the tree as its descendants. Then they, in turn, are also decomposed, and so on until the required level of detail is reached.

This approach has long been known in engineering and is used to build fault trees, the formation of which is standardized in GOST R 51901.13-2005 (IEC 61025:1990) Risk management. Analysis of the fault tree.

To illustrate the use of "threat trees", we will consider the formation of a threat model for an informatization object, which is an isolated computer that is not connected to a computer network. Let's assume that this object processes important information that needs to be secured.

As a high-level threat, we define the following: violation of the security properties of protected information.

Generally accepted security properties are confidentiality, integrity, and availability. Thus, child threats will be:

We decompose the threat of "violation of the confidentiality of protected data".

Let's ask ourselves the question: "How can this threat be implemented?" and write down the following options as an answer::

We will do the same with the threat of "violation of the integrity of protected data". It can be decomposed into:

The decomposition of the threat "violation of the availability of protected data" can be represented by the following threats::

As a result, we get the following tree:

As we can see, even such a primitive model that we have just built is quite cumbersome when it is displayed graphically. Therefore, "threat trees" are mostly documented as hierarchical lists.

This technique is based on the idea that when performing computer attacks, attackers always perform a certain similar sequence of actions, which can be called a template for a typical attack.

One of the most well-known computer attack patterns at the moment is the kill chain pattern described by Lockheed Martin Corporation, which includes 7 stages:

Stage 1. Intelligence-collecting data about the attacked object.

Stage 2. Weaponization – development of tools (malicious code) for conducting an attack.

Stage 3. Delivery – delivery of malicious code to the target object.

Stage 4. Penetration (Exploitation) – using any vulnerability of the node of the attacked object to run malicious code.

Stage 5. Installation – installation of a hidden remote access system on a compromised node.

Stage 6. Obtaining control (C2) - organizing a remote access channel for intruders to the compromised node.

Stage 7. Actions – performing the actions for which the attack was carried out.

The research organization MITRE, slightly changing the names of the stages, called this template-Cyber Attack Lifecycle.

In addition, MITRE expanded the description of various stages and formed a matrix of typical tactics of attackers at each stage. This matrix was named ATT&CK.

(clickable)

Although the above matrix is not universal, it still allows you to describe the actions taken by attackers when committing a large number of real attacks.

From the point of view of threat modeling, the template of a typical attack can be considered as a threat classifier, and the matrix of typical tactics can be considered as a significant fragment of the threat model.

Only the last stage of the template – "Actions" - will require clarification, which is what the attack was carried out for, and the stages themselves can be supplemented with tactics that were not taken into account.

Both documents are methodological, that is, they are not required to be applied, but they reveal how, in the opinion of the FSTEC of Russia, the problem of modeling personal data security threats should be solved.

The FSTEC Basic Model of Personal Data Threats, 2008 contains unified source data on security threats to personal data processed in the ISPDn related to:

Sets a formal description of threats:

The following abbreviations were used to formally describe threats::

ISPDn – personal data information system.

NSD – unauthorized access.

PMV – software and mathematical impact (introduction of malicious programs).

The document contains classification criteria for threats and vulnerabilities, as well as malware. A small catalog of typical threats related to leaks through technical channels and unauthorized access is provided. A typical model of violators is given and their capabilities are determined.

The methodology for determining actual threats of the 2008 PD defines an algorithm that can be used to filter threats based on insignificant risk. To do this, the methodology provides methods for determining the possibility of implementing a threat (probability), an indicator of the threat's danger (damage), and rules for classifying a security threat as not relevant (having an insignificant risk).

Methodological document of the FSTEC of Russia. Information security measures in state information systems (approved by the FSTEC of Russia on 11.02.2014). Information security threats (UBI) are determined based on the results of assessing the capabilities (potential, equipment and motivation) of external and internal violators, analyzing possible vulnerabilities in the information system, possible ways to implement information security threats and the consequences of violating information security properties (confidentiality, integrity, availability).

Formal description of the threat to information security:

UBI: = [capabilities of the intruder; vulnerabilities of the information system; method of implementing the threat; consequences of implementing the threat].

The capabilities (potential) of violators are divided into three groups:

An explanation of the capabilities of violators is given in the draft methodological document of the FSTEC of Russia. Methodology for determining information security threats in information systems.

Vulnerabilities are described and classified using national standards:

The vulnerabilities themselves, how threats are implemented, and possible damage are listed in the threat database of the FSTEC of Russia.

The guidelines identify the main threats to personal data that can be neutralized only with the help of SCSI. These include:

The document also defines a classification of violators capabilities:

Letter of the Central Bank of the Russian Federation No. 197-T dated December 7, 2007 "On risks in remote banking services" contains a list of typical threats to remote banking systems and their clients, including:

The Bank of Russia's Directive No. 3889-U of December 10, 2015 "On determining threats to the security of personal data Relevant to the processing of personal data in personal data information systems" contains an industry-specific list of threats to the security of personal data, including the following threats:

Recommendations in the field of standardization of the Bank of Russia RS BR IBBS-2.2-2009. "Methodology for assessing information security breach risks"

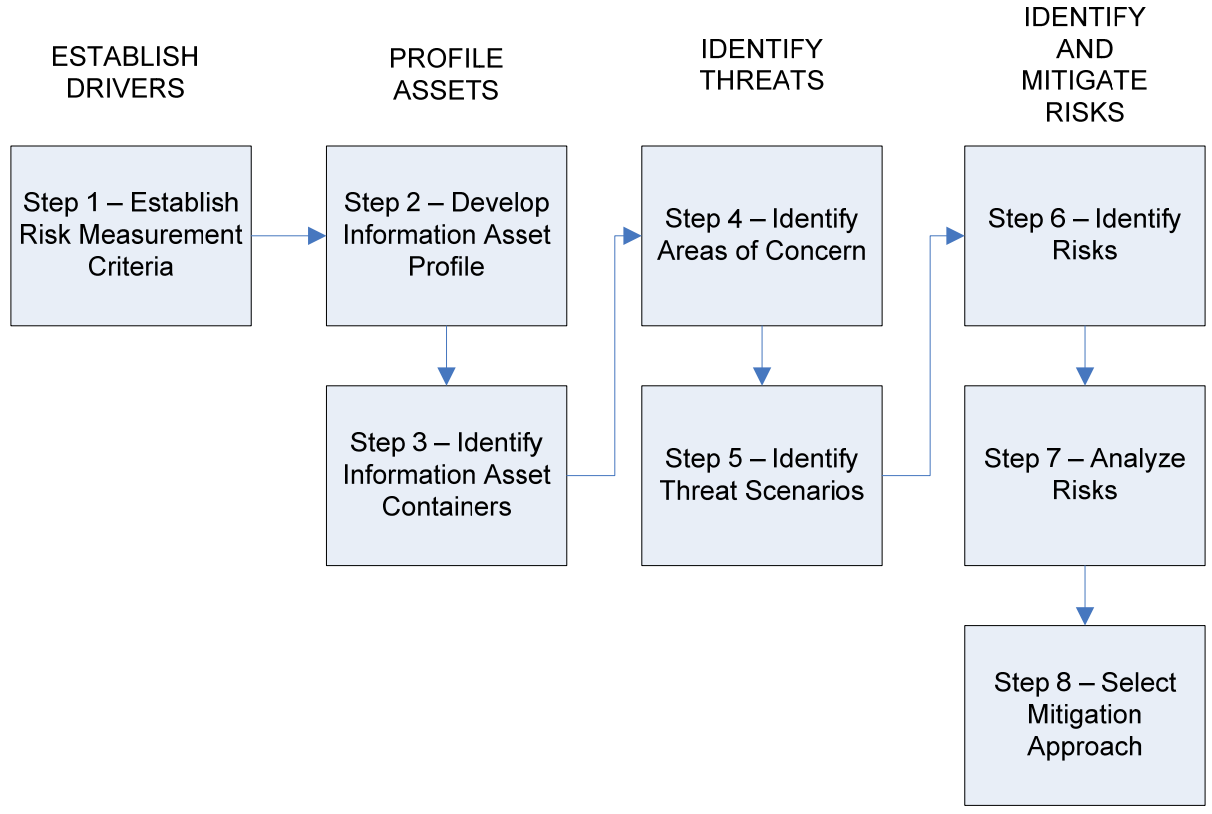

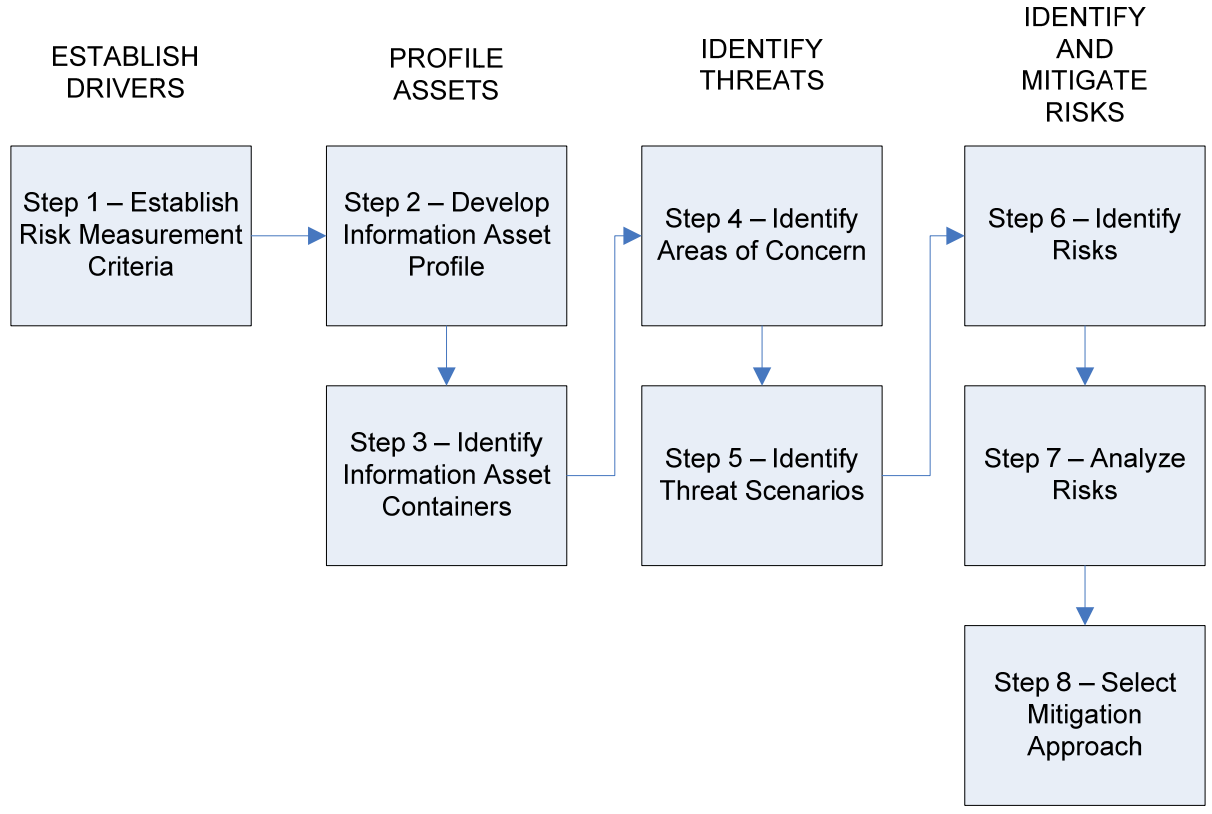

The document suggests the following risk assessment procedures::

Procedure 1. Determination of the list of types of information assets for which the procedures for assessing the risks of an information security breach are performed (hereinafter referred to as the area of assessing the risks of an information security breach).

Procedure 2. Determining the list of types of environmental objects corresponding to each of the types of information assets in the field of information security risk assessment.

Procedure 3. Identify sources of threats for each of the types of environment objects defined in procedure 2.

Procedure 4. Determination of the information security threat SVR in relation to the types of environmental objects defined in the framework of the procedure 2.3.

Procedure 5. Determination of the STP of an information security breach for the types of information assets in the information security risk assessment area.

Procedure 6. Assessment of information security breach risks.

The degree of risk tolerance is proposed to be assessed using the "classical" risk assessment table, which takes into account the probability and possible damage.

Here SVR is the degree of possibility of implementing the threat, and STP is the severity of the consequences.

The recommendations also contain a small catalog of threats, divided by class.

Class 1. Sources of information security threats related to adverse events of natural, man-made, and social nature

Class 2. Sources of information security threats related to the activities of terrorists and persons committing crimes and offenses

Class 3. Sources of information security threats related to the activities of suppliers/providers/partners

Class 4. Sources of information security threats related to failures, failures, destruction/damage of software and hardware

Class 5. Sources of information security threats related to the activities of internal information security violators

Class 6. Sources of information security threats related to the activities of external information security violators

Class 7. Sources of information security threats related to non-compliance with the requirements of supervisory and regulatory authorities and current legislation.

GOST R 51275-2006. Information protection. An informatization object. Factors affecting the information. General provisions

This GOST is ideologically related to GOST R 50922-2006 Information security. Basic terms and definitions, the methodological document " Special requirements and recommendations for the protection of confidential information (STR-K) "(DSP) and current documents on certification of informatization objects. The document contains a classification of factors that affect information that can be interpreted as threats to information security.

GOST R ISO / TO 13569-2007. Financial services. Information Security Recommendations

Appendix " C " of this standard contains an example of information security risk assessment for a credit and financial institution. To do this, it is proposed to analyze among the main objects of malicious impacts, including personnel, hardware, business applications, communication systems, software tools and operating systems. Risk damage is assessed as financial losses, reduced productivity, reputational damage, and total damage.

GOST R 56545-2015 Information security. Vulnerabilities of information systems. Rules for describing vulnerabilities and GOST R 56546-2015 Information security. Vulnerabilities of information systems. Classification of information system vulnerabilities are used to describe vulnerabilities in information systems. The standards are applied in conjunction with the fundamental GOST R 50922-2006 Information Security. Basic terms and definitions.

The standards provide a classification of information system vulnerabilities, which contains three classification features:

The vulnerabilities themselves are proposed to be described in the form of a passport containing the following sections:

The standards suggest using OVAL as the language of vulnerability detection rules.

GOST R 53113.1-2008 Information Technology (IT): Protection of information technologies and automated systems from information security threats implemented using hidden channels. Part 1. General provisions

The standard describes threats associated with hidden channels, which are defined as communication channels that are unintended by the developer of information technology and automated systems and can be used to violate the security policy.

GOST R 52448-2005 Information security. Ensuring the security of telecommunication networks. General provisions

This document is a methodological document for telecom operators and contains a general scheme of actions to protect communication networks.

It is proposed to use GOST R 51275-2006 as the basis of the threat modeling process. Information protection. An informatization object. Factors affecting the information. General provisions. The standard provides a model of alleged violators.

A distinctive feature of this document is that in addition to the classical properties of information security, such as confidentiality, integrity, and availability, the standard also considers accountability.

Under accountability, the standard defines a property that provides unambiguous tracking of network activities of any object. Violation of accountability — denial of actions in the network (for example, participation in a perfect communication session) or forgery (for example, creating information and claims that were allegedly received from another object or sent to another object).

GOST R ISO / IEC 27005-2010. Information technology. Methods and tools for ensuring security. Information security risk management

This standard is part of a group of information security standards, often referred to as ISO 27K. The document focuses on management procedures for managing information security risks.

Appendix C provides examples of typical threats, and Appendix D provides typical vulnerabilities.

NIST SP 800-30. Guide for Conducting Risk Assessments

The document focuses on risk management issues at the organization's management level.

NIST SP 800-39. Managing Information Security Risk

This document describes the methodology for managing enterprise-level information security risks. The main goal of the methodology is to link the information security system with the mission and goals of the organization

The threat tree methodology is used to identify threats performed in step 5.

Distinctive features of this methodology are:

Microsoft uses the Security Development Lifecycle methodology to develop secure software. This methodology is an extension to the "classic" cascade model of software development ("waterfall"), which introduces additional security-related steps. At the "design" stage, it is proposed to conduct threat modeling.

We suggest using several approaches to identify threats:

The STRIDE methodology is a classification scheme for describing attacks based on the type of exploits used to implement them or the attacker's motivation.

STRIDE is an acronym for the first letters:

After identifying threats, SDL suggests evaluating the risks they generate. The DREAD method can be used for this purpose.

The name of the DREAD method is also an acronym for the first letters of the risk assessment categories:

The risk itself is estimated by the formula:

Risk_DREAD = (DAMAGE + REPRODUCIBILITY + EXPLOITABILITY + AFFECTED USERS + DISCOVERABILITY) / 5,

where the value of composite elements varies from 0 to 10. For example, the Damage Potential value can be defined as:

At some point in time, the number of selected materials has grown into quality, so this selection may be of interest in itself.

2. "Hackers from Moscow face 10 years for stealing 20 million rubles from a bank”, – sobesednik.ru, 2015

4. Plot: "Theft from the Russian International Bank (RMB)"

a) "Hackers stole more than half a billion rubles from the correspondent account in the Central Bank," — interfax.ru, 2016

b) "Russian International Bank named the amount of funds stolen by hackers”, — rbc.ru, 2016

5. Plot: "Theft from Metallinvestbank"

a) "Hackers withdrew 677 million rubles. from the accounts of Metallinvestbank", – rbc.ru, 2016

b) ” Due to a hacker attack, Metallinvestbank lost 200 million rubles, " — ria.ru, 2016

c) "Metallinvestbank press release on theft", — metallinvestbank.ru, 2016

d) "Hacker-style robbery”, — kommersant.ru, 2017

6. "ABS didn't work”, – kommersant.ru, 2016

7. "Hackers stole almost 2 billion rubles from banks with the help of" letters from the Central Bank " – RBC.ru, 2016

8. "A million in a couple of minutes. How hackers rob banks around the world”, — 21.by, 2016

9. "Hackers" accused of embezzling more than 2.6 million rubles from bank accounts in various regions of the country will appear in court in the Sverdlovsk region" - Prosecutor General's Office of the Russian Federation, 2016

10. Plot: Hacker group Lurk

) "Lurk Banking Trojan: specially designed for Russia", — Securelist.ru, 2016

b) "Employees of the Russian Ministry of Internal Affairs and the Federal Security Service of Russia detained Internet hackers”, - Ministry of Internal Affairs of Russia, 2016

c) "Hunting for Lurk”, — Securelist.ru, 2016

11. "The court recovered 470 million rubles from the processing company UCS”, — vedomosti.ru, 2016

13. "Group-IB assessed the scale of activity of Russian-speaking hackers MoneyTaker”, — rbc.ru,2017

14. "The co-founder of Group-IB spoke about those who committed a cyber attack on Russian banks”" — rbc.ru, 2017

15. Plot: "Theft from the bank "Globex"

a) "Hackers came running to SWIFT”, — kommersant.ru, 2017

b) "Hackers came to Globex, — kommersant.ru, 2017

c) "Hackers stole $1 million from a VEB subsidiary bank”, — vedomosti.ru, 2017

16. "Hacker attacks were grouped together”, — Коммерсант.ги, 2017

17. "Digital Security denies Zeronights member's connection to MoneyTaker", — anti-malware.ru, 2017

18. Plot: A group of 14 hackers robbing banks

a) "A boxer from Ukraine led a group of hackers who stole 1 billion rubles from banks”" — Life.ru, 2016

b) "The hacker's remorse program worked”" — kommersant.ru, 2017

c) "The court breaks into a hacker network”,- kommersant.ru, 2017

20. Plot: "Criminal group from Volzhsky"

a) "A hacker who stole funds from bank cards was detained in Volzhsky”" - SecurityLab.ru, 2018

b) "Hackers earned up to half a million a day”, — Коммерсант.ги, 2018

21. Plot: "Preparing for an attack on Russian payment systems"

a) "In Seversk, a hacker was convicted for preparing an attack on Russian payment systems”" — SecurityLab.ru, 2018

b) "A cyberattack on Russian electronic payment systems was prevented in Tomsk”, — ib-bank.ru, 2018

22. "In the Stavropol Territory, a hacker was detained for hacking ATMs and stealing funds”" - SecurityLab.ru, 2018

23. "In Saratov, a hacker stole more than 380 thousand rubles using a phishing site”, — SecurityLab.ru, 2018

24. "St. Petersburg hacker stole funds from bank cards”, — SecurityLab.ru, 2018

25. "Ghost hackers steal money from the Central Bank”, — dailystorm.ru, 2018

26. "Novice hackers have teachers on hacking ATMs," — dni24.com, 2018

27. Plot: "Arrest of the leader of the criminal group Carbanak / Anunak / Cobalt"

) “Mastermind behind eur 1 billion cyber bank robbery arrested in spain”, — Европол, 2018 + (here)

b) "A Ukrainian hacker, allegedly the leader of Carbanak, has been arrested," -SecurityLab.ru, 2018

c) "The leader of Carbanak got caught on unwillingness to pay for the car on time”, — SecurityLab.ru, 2018

28. Plot: "The continuation of the activity of the criminal group Cobalt after the arrest of its leader"

a) "Group-IB: Despite leader's arrest, Cobalt group continues attacks on banks” - Group-IB, 2018

b) "The arrest of the leader did not stop the activities of the Cobalt group: hackers attacked major banks in Russia and the CIS”" — xakep.ru, 2018

29. "Cybercriminals who stole funds from bank customers have been convicted in Moscow —" SecurityLab reports.Ru, 2018

30. "PIR Bank lost more than 58 million rubles as a result of a cyber attack —" - SecurityLab.Ru, 2018

31. "The investigative bodies of the Ministry of Internal Affairs of Russia sent to the court a case on embezzlement of funds from bank cards of citizens", - The Ministry of Internal Affairs of Russia, 2018

32. "Cyber fraudsters convicted in Moscow for stealing money through online banking accounts” - Interfax news agency, 2018

33. Plot: "Theft from the" PIR Bank "

a) "PIR for hackers", — kommersant.ru, 2018

b) "How do you like this, Carbanak?", — Gorup-ib.ru, 2018

34."The Prosecutor's Office of the Republic of Bashkortostan sent a criminal case to the court on the fact of theft by hackers of more than 8 million rubles”" - the Prosecutor General's Office of the Russian Federation, 2018

35. "In the US, a court has charged 3 members of the hacker group Carbanak", — SecurityLab.ru, 2018

36. "Yekaterinburg hackers stole 1.2 billion rubles from banks," — SecurityLab.ru, 2018

37. "In Rostov, a hacker stole more than 1 million rubles from an ATM", — SecurityLab.ru, 2018

38. "Hackers have withdrawn about $ 100,000 from the Housing Finance Bank," RIA Novosti, 2018

3. Report: "Attacks on brokerage and settlement systems”, - Group-IB, 2015

4. Big Bank Heist: The Carbanak APT campaign, – securelist.ru, 2015 (+ english report)

6. Report: "Buhtrap: Evolution of targeted attacks on banks”, - Group-IB, 2016

7. Отчет: “Cobalt snatch”, — Positive Technologies, 2016

9. "Following the trail of Cobalt: tactics of a logical attack on ATMs in the investigation of Group-IB”,-Group-IB company blog on habr.com, 2017

10. "Secrets of Cobalt As the Cobalt Group overcomes security measures”, - Group-IB, 2017

11. "MoneyTaker: Group-IB Stealth hunt declassifies hackers attacking banks in the US and Russia” - Group-IB, 2017

12. "Lazarus Technologies of espionage and targeted attacks by pro-government hackers from North Korea and unknown details of their operations in the Group-IB report "Lazarus: Architecture, Tools, attribution", - Group-IB, 2017

13. Attacks on ATMs on the example of GreenDispenser: organization and technology”, - Positive Technologies, 2017

14. "The Silence — a new targeted attack on financial institutions", — Securelist.ru, 2017

15. "TwoBee Financial Campaign", — Securelist.ru, 2017

17. "New attacks on banks” - Positive Technologies, 2018

18. Webinar: "Research on targeted attacks on financial institutions”, - Positive Technologies, 2018 (+ presentation)

19. "Attacks on industrial enterprises using RMS and TeamViewer", — Securelist.ru, 2018

20. "Hackers attack banks using Microsoft Publisher files", — SecurityLab.ru, 2018

3. "Report of the Center for Monitoring and Responding to Computer attacks in the Credit and Financial Sector of the Main Directorate for Information Security and Protection of the Bank of Russia: June 1, 2016-September 1, 2017", - FinCERT of the Central Bank of the Russian Federation, 2017

4. "The main types of attacks in the credit and financial sector in 2017”, - FinCERT of the Central Bank of the Russian Federation, 2017

5. "Review of unauthorized money transfers in 2017”, - FinCERT of the Central Bank of the Russian Federation, 2017

6. "Cybercriminals against Financial institutions: what to expect in 2018", — Securelist.ru, 2017

7. Webinar: "Current cyber threats-2017: trends and forecasts”, - Positive Technologies, 2018 (+ report)

1. "Materials of court proceedings between JSC Kemsotsinbank and other banks through which the money stolen from it was cashed" - Arbitration and Appeal Courts, 2017-18 (here and here)

2. "Archive securelist.ru, category "Attack on banks", — securelist.ru

3. FinCERT of the Bank of Russia, — Bank of Russia

4. "Investigations of high-tech crimes”, - Rubricator on the site Group-IB.ru

5. The story " Hacker attacks on Russian banks”, - RIA Novosti

6. Threat Actor Map

7. Category: "Burglary guards", — Komersant.ru

8. "Rubricator: Cybercrime on the official website of the Ministry of Internal Affairs of Russia" — - Ministry of Internal Affairs of Russia

9. Periodic reports: State of Crime — Ministry of Internal Affairs of Russia

3. "VM escape: 101", - Digital Security company blog on habr.com, 2014

7. "Automated Code Analysis: Web application vulnerability statistics for 2017”, - Positive Technologies, 2017

8. "Statistics of attacks on web applications: IV quarter of 2017”, - Positive Technologies, 2017

9. "Corporate information Systems: penetration testing attack scenarios”, - Positive Technologies, 2017

10. Webinar: "Typical scenarios of attacks on wireless networks”, - Positive Technologies, 2017 (+ presentation)

11. Webinar: "Typical scenarios of attacks on a corporate information system”, - Positive Technologies, 2017 (+ presentation)

13. Webinar: "Advanced attacks on Microsoft Active Directory: ways to detect and protect", - Positive Technologies, 2018 (+ presentation)

14. "Vulnerabilities of corporate information systems 2018", - Positive Technologies, 2018

15. "How Social Engineering opens doors to hackers in your organization” - Positive Technologies, 2018

16. Webinar: "ATM Security Analysis: logical attacks and vulnerabilities”, - Positive Technologies, 2018 (+ presentation)

17. "They got to the bills through the safe," — kommersant.ru, 2018

18. "Low-level hacking of NCR ATMs", - Positive Technologies company blog on habr.com, 2018

2014

2. "Attacks on automated banking systems”, BIS-journal, 2014

4. "21st Century Heist: Hackers managed to steal $1 billion” - Kaspersky Lab, 2015

5. “Russian financial cybercrime: how it works”, — securelist.com, 2015

7. "A banker who can steal everything” – securelist.com, 2016

8. "Hackers against banks: the most high-profile crimes of recent years", — Rbc.ru, 2016

10. "Targeted attacks on banks Russia as a testing ground”, - Group-IB, 2017

11. "Hacker-style robbery”, — Kommersant.ru, 2017

13. "$3,000 per night. How do cybercriminals who can rob anyone work? " — tut.by, 2018

14. "Cyber attacks are our daily routine. Hackers targeted mobile banks and industry”, — 360tv.ru, 2018

15. "Attacks on banks”, - Positive Technologie, 2018

16. "Theft schemes in RBS systems and five levels of countering them",-Group-IB company blog on habr.com, 2018

17. "Pegasus crept up unnoticed", — Kommersant.ru, 2018

18. "Criminal Cyber Services Market 2018", - Positive Technology, 2018

19. "Trojans are multiplying in mobile banking", — Kommersant.ru, 2018

20. «APT Trends Report Q2 2018», — Securelist.com, 2018

21. "On crimes committed using modern information and communication technologies" — Prosecutor General's Office of the Russian Federation, 2018

(c) The Ministry of Internal Affairs of Russia. A fragment of surveillance footage from the moment when money was stolen from an ATM

Further in the article we will present a sample of more than one hundred real crimes of recent years. All considered crimes will be classified and provided with a brief description. Then a comprehensive analysis will be conducted, which will provide answers to the main questions of banking security, in particular:

The sources of data on crimes included in the sample were articles on news resources and press releases of law enforcement agencies: the Ministry of Internal Affairs of the Russian Federation, the Prosecutor General's Office of the Russian Federation, the Investigative Committee of the Russian Federation, etc.

Given the huge number of" ordinary " crimes, the sample size for them was limited to the last year — approximately from 07.2017 to 07.2018. The time range of the analyzed "computer" crimes is wider — from 2015 to 2018.

From the point of view of banking security, the most important factors in the analysis of crimes will be:

Based on the above, all the crimes under consideration were classified as follows::

In the beginning, they were divided into two types:

Then crimes of each type were divided into two categories:

Each of the resulting categories, in turn, was divided into two more types:

The generalized classification scheme is as follows:

The description of each crime includes the name and reference of the original article, followed by a summary description of the crime as a table.

Example.

"In Krasnoyarsk, the police detained suspects in the theft of 15 million rubles from ATMs," - Banks. <url>, 2018

Here:

Crime type-contains a brief description of the crime.

Articles of the Criminal Code of the Russian Federation — contains a list of articles of the Criminal Code of the Russian Federation, according to which law enforcement agencies have qualified this crime.

Damage (million rubles — - contains the amount of total damage caused by the crime, expressed in millions of rubles. If the crime involved amounts in foreign currency, they were converted into rubles at the rate of 60 rubles per US dollar and 70 rubles per euro. In cases where the amount of the attempted theft differs from the amount of actual losses, the first amount is indicated.

Maximum penalty (years of imprisonment) - contains information about the maximum penalty that was imposed on criminals for committing this crime.

Information about criminals-contains a description of the persons who committed the crime.

If the source does not contain the required data, then “- ”is indicated in the corresponding column of the description.

Given the huge amount of data, descriptions of all crimes are hidden under spoilers.

For an adequate interpretation of the results obtained in this article, it is necessary to take into account the following facts:

List of “ordinary " crimes committed by individuals who are not employees of the bank

1. "A resident of Izhevsk received more than eight years in a high-security penal colony for a raid on a bank," - Banks.<url>, 2018

2. "In the Krasnoyarsk Territory, employees of the Ministry of Internal Affairs of Russia detained a suspect during the day in an attempt to steal more than 2 million rubles from an ATM," - the Ministry of Internal Affairs of Russia, 2018

3. "6.5 million rubles were stolen from an ATM in Moscow," — Banks.<url>, 2017

4. "A man who tried to steal more than a million rubles from an ATM was sentenced in Udmurtia" - Russian Interior Ministry, 2017

5. "A person accused of robbing a bank branch in Primorsky Krai will appear in court," the Russian Ministry of Internal Affairs, 2017

6. "An unknown person robbed a bank in Yekaterinburg" - RIA Novosti, 2017

7. "In Udmurtia, a suspect in a robbery attack on a bank was detained," - Banks.<url>, 2017

8. "Krasnoyarsk police sent a criminal case to the court on the fact of a robbery attack on a bank branch", - The Ministry of Internal Affairs of Russia, 2017

9. "In the Kostroma region, a criminal with a hunting rifle tried to rob the mobile office of Sberbank," - Banks.<url>, 2017

10. "In the Tula region, a court issued a verdict in a criminal case on embezzlement of about 3 million rubles from commercial banks through the conclusion of fictitious loan agreements," the Prosecutor General's Office of the Russian Federation, 2018

11. The plot "Robber from the Federal Penitentiary Service":

a) "Ex-employee of the Federal Penitentiary Service of the Samara region was sentenced for bank robbery" - Volga News, 2017

b) "Victims of the Solidarity Bank robbery demand a million rubles from the offender," Volga News, 2017

12. The plot of "Robber fitness trainer":

a) "Kazan fitness trainer was given 10 years for robbery in Bystrobank", - Realnoe vremya, 2017

b) "Fast robbery: "gangster" stole almost 5 million rubles from the Kazan "Bystrobank", - Realnoe vremya, 2016

The number of crimes considered is 12.

The minimum damage caused by a crime is 624 thousand rubles.

The maximum damage caused by a crime is 8 million rubles.

The minimum penalty for a crime is 3 years in prison.

The maximum penalty for the crime is 10 years in prison.

Crimes committed by women:

Crimes committed by men:

The main crimes in this group are crimes related to the manifestation of violence, namely robberies on bank branches and physical hacking of ATMs. These crimes were usually committed by men in their 30s and 40s, and two cases deserve special attention. The first is a crime committed by a former employee of the Federal Penitentiary Service, and the second is a robbery committed by a former fitness trainer. If the first case is indicative of the fact that the crimes were committed by a person who was called upon to protect the law, then the second case partly resembles the plot of the film "Blood and Sweat: Anabolics", where the main criminal was also a fitness trainer, although he robbed not a bank, but his client.

Female offenders, unlike men, generally do not commit violent crimes. Instead, they use cunning and guile. So the only crime in this group committed by a woman is fraud in the field of lending, namely, the registration of fictitious loans using stolen personal data of individuals.

List of “ordinary " crimes committed by lone employees of the bank

1. "In Orenburg, the former manager of a bank branch was sent to a penal colony for embezzlement of 16 million rubles," - Banks.<url>, 2018

2. "An employee of one of the banks was detained by police in Balashikha, Moscow region, on suspicion of fraud," the Ministry of Internal Affairs of Russia, 2018

3. "In the city of Sharya, Kostroma region, the former director of a branch of a commercial bank is accused of fraud and embezzlement of funds", - the Ministry of Internal Affairs of Russia, 2018

4. "A businessman suspected of fraud in the amount of 150 million rubles was arrested in St. Petersburg", - Russian Interior Ministry, 2018

5. "In the Sverdlovsk region, according to police materials, a former bank employee was convicted of embezzling securities worth 20 million rubles", - the Ministry of Internal Affairs of Russia, 2017

6. "In Khabarovsk, a bank employee is suspected of embezzling three million rubles from pensioners," - Russian Interior Ministry, 2017

7. "The ex-head of Ergobank is accused of embezzlement of money," - Banks.<url>, 2017

8. "In the Novosibirsk region, a cashier who robbed a bank received 3 years of probation" - Prosecutor's Office of the Novosibirsk region, 2017

9. "A criminal case was sent to the court in Nizhny Tagil on charges of fraud against a former manager of a financial and credit institution," the Ministry of Internal Affairs of Russia, 2017

10. "A suspect in especially large-scale fraud was detained in St. Petersburg," - Russian Interior Ministry, 2017

11. "Police officers in Udmurtia detained a bank employee suspected of embezzling almost two million rubles," - Russian Interior Ministry, 2017

12. "An employee of a bank faces up to ten years for embezzlement of money from clients and financial institutions", — Banks.<url>, 2017

13. "In the Kirov region, an ex-employee of a bank stole almost 1 million rubles from depositors," — Banks.<url>, 2017

14. " The ex - manager of Sberbank is accused of stealing 1 billion rubles. from the accounts of VIP clients", - Volga News, 2017

15. "The duty officer of the collection station stole 4.2 million rubles," - Prosecutor General's Office of the Russian Federation, 2017

16. "In Khakassia, a bank cashier embezzled money and went on a trip" - Banks.<url>, 2017

17. "Deputy Chairman of the South-Western Bank of Sberbank detained in Rostov-on-Don", - TASS news agency, 2017

18. "A criminal case has been opened in the Penza Region against a cash collector who embezzled about two million rubles," the Ministry of Internal Affairs of Russia, 2017

19. "In Volgograd, a bank teller stole more than 13 million rubles and disappeared with her family," - Russian Interior Ministry, 2017

20. "In the Samara region, a criminal case was sent to the court against a bank manager accused of fraud", - the Ministry of Internal Affairs of Russia, 2017

21. "In the Republic of Crimea, police officers exposed the illegal scheme of a former bank employee," - Russian Interior Ministry, 2017

22. "GSU of the Metropolitan Police sent to the court a criminal case on an attempt to disclose information constituting a bank secret", - Ministry of Internal Affairs of Russia, 2017

The number of crimes considered is 22.

The minimum damage caused by a crime is 172 thousand rubles.

The maximum damage caused by a crime is 1 billion rubles.

The minimum penalty for a crime is 2 years in prison.

The maximum penalty for the crime is 4 years in prison.

Crimes committed by women:

Crimes committed by men:

Positions of criminals:

The following typical scenarios can be distinguished in crimes of this group:

An interesting fact is that in this group, the overwhelming majority of criminals are women, and their behavior can be divided into two archetypes:

In the list of crimes of this group, there is a case that is not related to the analyzed banking crimes, but still quite interesting. This is a case in which a bank employee "leaked" a customer database and then tried to sell it. However, he was caught red-handed.

List of “ordinary " crimes committed by groups of individuals without the participation of bank employees

1. "The Prosecutor's Office of the Kabardino-Balkar Republic approved an indictment in a criminal case on six episodes of fraud in the amount of more than 16 million rubles" — - Prosecutor General's Office of the Russian Federation, 2018

2. "A bank was robbed in Moscow in two minutes," Lenta reports.<url>, 2018

3. "Employees of the Ministry of Internal Affairs of Russia detained suspects in a robbery committed in a credit institution", - Ministry of Internal Affairs of Russia, 2018

4. "The court sent robbers to the Moscow bank office in a penal colony," - Banks.<url>, 2017

5. "Participants of bank robberies convicted in Sverdlovsk and Rostov regions" — Prosecutor General's Office of the Russian Federation, 2017

6. "Employees of the Ministry of Internal Affairs of Russia revealed a scheme of embezzlement of 500 million rubles", - Ministry of Internal Affairs of Russia, 2017

7. "In the Angara region, a sentence was passed to members of an organized group accused of robberies on financial institutions", - the Ministry of Internal Affairs of Russia, 2017

8. "Moscow found guilty of members of an organized group who stole over 98 million rubles from clients of the capital's banks," - Russian Interior Ministry, 2017

9. "Two unknown people stole 4.5 million rubles from an ATM in St. Petersburg", - Channel 5, 2017

10. "The Prosecutor's Office of the Volgograd region sent to the court a criminal case on fraud in the amount of more than 739 million rubles," - Prosecutor General's Office of the Russian Federation, 2017

11. "The case of embezzlement of more than 4 billion rubles from Otkritie Bank is divided into episodes," Kommersant, 2017

12. "Three citizens stole more than 52 million rubles from three large banks under the guise of consumer loans," — Banks.<url>, 2017

13. "In the Voronezh Region, a criminal case was sent to the court against three citizens who committed a series of bank robberies", - The Ministry of Internal Affairs of Russia, 2017

14. "A person involved in a criminal case on embezzlement of 132 million rubles from one of the capital's banks was found guilty in Moscow," the Ministry of Internal Affairs of Russia, 2017

15. "The court will consider the case of embezzlement of more than 134 million rubles from one of the capital's banks —" - Banks.<url>, 2017

16. "The case of embezzlement of 160 million rubles from banks was transferred to the court", - Banks.<url>, 2017

17. "In Chuvashia, a criminal case was sent to the court on charges of fraud", - The Ministry of Internal Affairs of Russia, 2017

18. "Members of an organized group who stole more than 98 million rubles from clients of Moscow banks will be brought to trial", - Ministry of Internal Affairs of Russia, 2017