For those who have not yet decided how to accept payments on the site, we will analyze the basic concepts associated with online payments.

How to accept payments online.

Entrepreneurs new to the payment processing industry often come across dozens of new terms. Payment gateway, payment operator, merchant account - all these terms mean absolutely nothing to them. To make matters worse, people often think of these terms interchangeably. However, it is not.

While all of these terms are related to payment processing, they do not mean the same thing. In this article, we will understand each of them.

What is a payment gateway?

A payment gateway is a technical solution that allows online business owners to accept payment on a website using bank cards. This gateway is the link between the site and the acquiring partner. It provides verification of customer data in the shortest possible time, and also encrypts information to prevent data leakage.

When choosing a reliable payment gateway, merchants and service providers need to ensure that it is PCI DSS compliant.

Inside the payment gateway, information is exchanged (between the issuing bank, merchant, client and acquiring bank). Even if a standard transaction takes only 10 seconds, the process of exchanging information (information flow) contains nine steps.

The downside: what happens after the buyer clicks "Buy"

A large bank has launched a new service for purchasing railway tickets.

1. The user places an order online and decides to pay by credit card. He clicks on the “Buy” button and the website redirects him to the checkout page, where he enters his credit card details. He confirms the action and proceeds to the next stage.

2. The data entered by the user is sent to the merchant, who forwards it to the payment gateway (along with the order amount).

3. This is followed by an authorization request sent by the payment gateway to the acquiring bank and then to the international payment system (IPS - MasterCard / AmEx / Visa). Thus, the issuing bank makes sure that the buyer's card exists and is valid.

4. If the card is protected by 3D Secure, the client will be redirected to a page with a password entry form (to make sure that he is the owner of the card). As soon as the password is confirmed, the issuing bank sends an IPS notification.

5. The IPS sends the confirmation to the acquiring bank.

6. The payment gateway requests that the acquiring bank withdraw the order amount from the payment card.

7. The issuing bank ascertains whether there are enough funds in the client's account. If enough, it sends the required amount of money and confirms the IPS transaction.

8. Mastercard / AmEx / Visa sends confirmation to the acquiring bank and payment gateway.

9. Within 15 minutes, the merchant receives information on the transaction in case of its successful completion. The funds are immediately withdrawn from the cardholder's account.

Payment Service Provider (PSP)

A payment service provider (PSP) is a company that provides merchants and banks with online services for making electronic payments in a variety of ways. Among them - payment with ordinary bank cards, payments from a bank account directly, electronic money, etc.

Each payment operator uses special software to process, store and analyze merchant transactions.

Payment service providers act as intermediaries between the cardholder, merchant, acquiring bank, payment gateway and the issuing bank. They help customers make online payments in seconds, freeing merchants from the need to develop their own software.

Merchant account

A merchant account is an agreement between a merchant and an acquiring bank that allows the former to receive and process credit card payments. The money debited from the card (debit or credit) goes to the company's bank account thanks to the processing center.

A merchant account is required for those who want to expand their audience. More and more people want to pay for goods and services not in cash, but by credit cards.

To make sure you make the right choice, you should pay attention to some details.

What to look for when choosing a merchant account provider

What cards do customers use

What cards do customers use

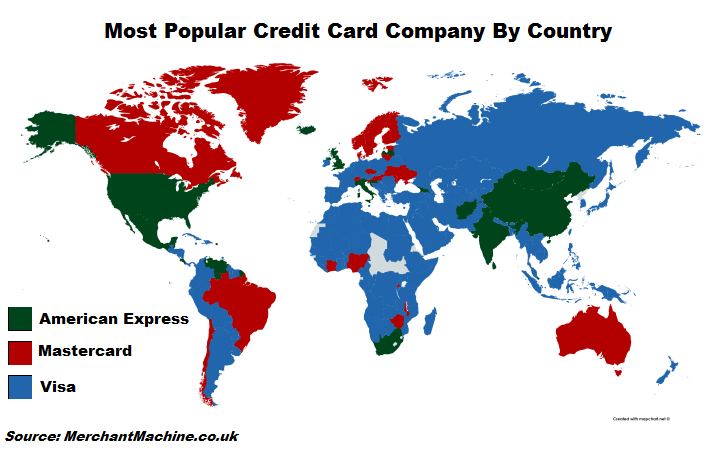

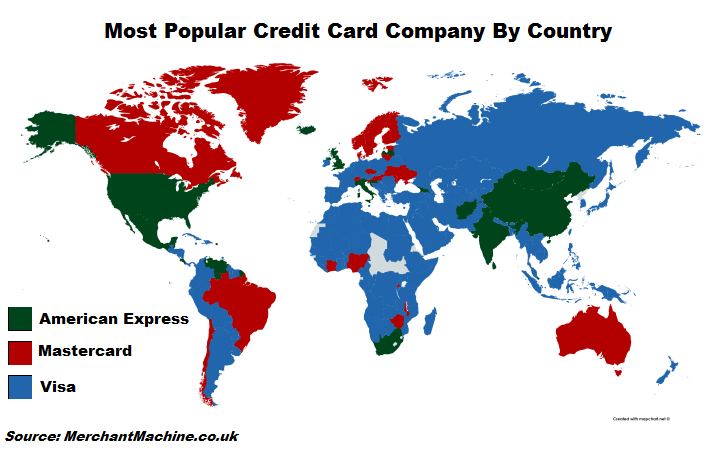

According to statistics, Visa ranks 1st in the list of popularity of credit cards in more than 120 countries, but it is not a fact that the clients of a particular merchant will have cards of this PS prevailing. Therefore, it is worth doing your research before starting work.

Choose a payment model

Choose a payment model

Depending on what goods and services the merchant is offering, the business must be able to offer different payment models - a one-time payment or a recurring payment. The conditions for these types of payments are different, so you should voice all the details and nuances before signing the agreement.

Consider all possible local options

Consider all possible local options

The most suitable option is to contact your local bank. The exception is international business. In this case, opening a local bank account will significantly slow down the payment processing process.

Website Checker

Website Checker

Any merchant account provider will check the merchant's website for Mastercard and Visa requirements. It is worth preparing for the check in advance.

A clear understanding of these three terms - payment gateway, payment service and merchant account - will help you take your first steps into the world of online business.

How to accept payments online.

Entrepreneurs new to the payment processing industry often come across dozens of new terms. Payment gateway, payment operator, merchant account - all these terms mean absolutely nothing to them. To make matters worse, people often think of these terms interchangeably. However, it is not.

While all of these terms are related to payment processing, they do not mean the same thing. In this article, we will understand each of them.

What is a payment gateway?

A payment gateway is a technical solution that allows online business owners to accept payment on a website using bank cards. This gateway is the link between the site and the acquiring partner. It provides verification of customer data in the shortest possible time, and also encrypts information to prevent data leakage.

When choosing a reliable payment gateway, merchants and service providers need to ensure that it is PCI DSS compliant.

Inside the payment gateway, information is exchanged (between the issuing bank, merchant, client and acquiring bank). Even if a standard transaction takes only 10 seconds, the process of exchanging information (information flow) contains nine steps.

The downside: what happens after the buyer clicks "Buy"

A large bank has launched a new service for purchasing railway tickets.

1. The user places an order online and decides to pay by credit card. He clicks on the “Buy” button and the website redirects him to the checkout page, where he enters his credit card details. He confirms the action and proceeds to the next stage.

2. The data entered by the user is sent to the merchant, who forwards it to the payment gateway (along with the order amount).

3. This is followed by an authorization request sent by the payment gateway to the acquiring bank and then to the international payment system (IPS - MasterCard / AmEx / Visa). Thus, the issuing bank makes sure that the buyer's card exists and is valid.

4. If the card is protected by 3D Secure, the client will be redirected to a page with a password entry form (to make sure that he is the owner of the card). As soon as the password is confirmed, the issuing bank sends an IPS notification.

5. The IPS sends the confirmation to the acquiring bank.

6. The payment gateway requests that the acquiring bank withdraw the order amount from the payment card.

7. The issuing bank ascertains whether there are enough funds in the client's account. If enough, it sends the required amount of money and confirms the IPS transaction.

8. Mastercard / AmEx / Visa sends confirmation to the acquiring bank and payment gateway.

9. Within 15 minutes, the merchant receives information on the transaction in case of its successful completion. The funds are immediately withdrawn from the cardholder's account.

Payment Service Provider (PSP)

A payment service provider (PSP) is a company that provides merchants and banks with online services for making electronic payments in a variety of ways. Among them - payment with ordinary bank cards, payments from a bank account directly, electronic money, etc.

Each payment operator uses special software to process, store and analyze merchant transactions.

Payment service providers act as intermediaries between the cardholder, merchant, acquiring bank, payment gateway and the issuing bank. They help customers make online payments in seconds, freeing merchants from the need to develop their own software.

Merchant account

A merchant account is an agreement between a merchant and an acquiring bank that allows the former to receive and process credit card payments. The money debited from the card (debit or credit) goes to the company's bank account thanks to the processing center.

A merchant account is required for those who want to expand their audience. More and more people want to pay for goods and services not in cash, but by credit cards.

To make sure you make the right choice, you should pay attention to some details.

What to look for when choosing a merchant account provider

According to statistics, Visa ranks 1st in the list of popularity of credit cards in more than 120 countries, but it is not a fact that the clients of a particular merchant will have cards of this PS prevailing. Therefore, it is worth doing your research before starting work.

Depending on what goods and services the merchant is offering, the business must be able to offer different payment models - a one-time payment or a recurring payment. The conditions for these types of payments are different, so you should voice all the details and nuances before signing the agreement.

The most suitable option is to contact your local bank. The exception is international business. In this case, opening a local bank account will significantly slow down the payment processing process.

Any merchant account provider will check the merchant's website for Mastercard and Visa requirements. It is worth preparing for the check in advance.

A clear understanding of these three terms - payment gateway, payment service and merchant account - will help you take your first steps into the world of online business.