Carding Forum

Professional

- Messages

- 2,788

- Reaction score

- 1,323

- Points

- 113

Payment card leaders targeting B2B

Visa, Mastercard, Amex have placed their bets on B2B.

Looking back at the biggest events in B2B payments in the past year, it's hard to get around international payment systems. Visa, Mastercard and American Express invested in innovation in 2021 to drive digital B2B payments.

Visa developed cross-border corporate payments and value-added financial services for organizations. Mastercard has worked to improve its international trade management. And American Express has relied on blockchain.

Visa and distributed B2B payments

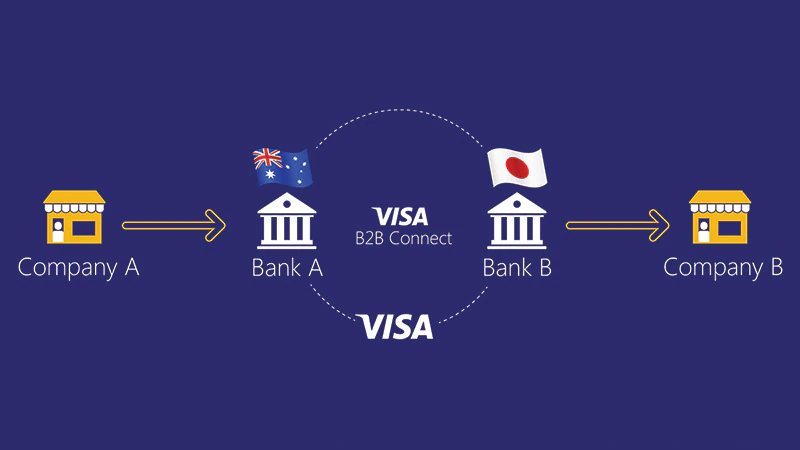

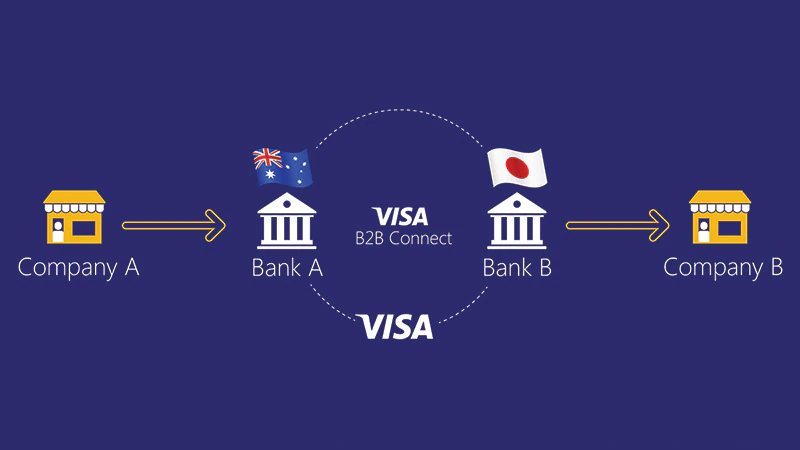

Visa focused on B2B payments in 2020, and in 2021 it continued to develop this area and began testing and expanding B2B Connect, its solution for international corporate payments that uses distributed ledger technology.

Also in February 2021, Visa announced the acquisition of Fraedom. The expense management company has previously partnered with PS to operate the internal IntelliLink platform. After the acquisition, Visa will be able to offer corporate clients new functionality to optimize payments.

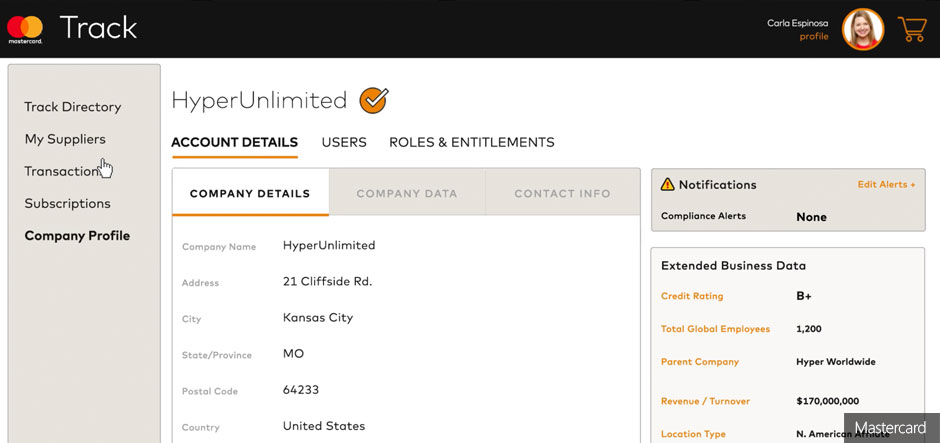

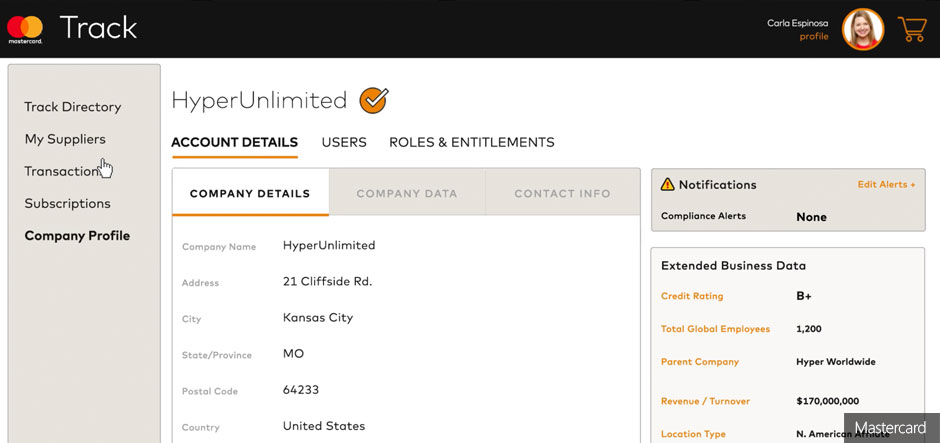

The new service is designed to optimize and automate the supply chain management process from purchase to payment. It will allow business clients to store, receive and exchange any key information about trade operations, as well as track payments. Mastercard Track will be launched in phases starting this year.

American Express bets on blockchain in B2B

American Express has relied on blockchain this year as part of its B2B payments initiatives. The payment system has filed several blockchain-related patents and has continued to invest in the technology itself. Also last year, American Express began partnering with the Ripple platform and conducted a pilot with the global payment network RippleNet, which allows you to conduct a money transaction from one part of the world to another in just a few seconds. Testing took place on the basis of Santander bank.

Carlos Carrido, CEO of Corporate Payments for American Express, also said the company will continue to invest in blockchain in 2019.

PAYSPACE MAGAZINE HELP

Earlier we wrote that Ant Financial will buy an international money transfer service. Alibaba subsidiary plans to buy UK money transfer service WorldFirst. The acquisition of WorldFirst is estimated at $ 700 million.

Visa, Mastercard, Amex have placed their bets on B2B.

Looking back at the biggest events in B2B payments in the past year, it's hard to get around international payment systems. Visa, Mastercard and American Express invested in innovation in 2021 to drive digital B2B payments.

Visa developed cross-border corporate payments and value-added financial services for organizations. Mastercard has worked to improve its international trade management. And American Express has relied on blockchain.

Visa and distributed B2B payments

Visa focused on B2B payments in 2020, and in 2021 it continued to develop this area and began testing and expanding B2B Connect, its solution for international corporate payments that uses distributed ledger technology.

Also in February 2021, Visa announced the acquisition of Fraedom. The expense management company has previously partnered with PS to operate the internal IntelliLink platform. After the acquisition, Visa will be able to offer corporate clients new functionality to optimize payments.

Mastercard will connect buyers and suppliers

At the end of the year, Mastercard said B2B payments are a key component of its growth in 2018. Summing up the results of the third quarter, CEO Ajay Banga told analysts that the launch of Mastercard Track is one of the highlights of the company for the year.The new service is designed to optimize and automate the supply chain management process from purchase to payment. It will allow business clients to store, receive and exchange any key information about trade operations, as well as track payments. Mastercard Track will be launched in phases starting this year.

American Express bets on blockchain in B2B

American Express has relied on blockchain this year as part of its B2B payments initiatives. The payment system has filed several blockchain-related patents and has continued to invest in the technology itself. Also last year, American Express began partnering with the Ripple platform and conducted a pilot with the global payment network RippleNet, which allows you to conduct a money transaction from one part of the world to another in just a few seconds. Testing took place on the basis of Santander bank.

Carlos Carrido, CEO of Corporate Payments for American Express, also said the company will continue to invest in blockchain in 2019.

PAYSPACE MAGAZINE HELP

Earlier we wrote that Ant Financial will buy an international money transfer service. Alibaba subsidiary plans to buy UK money transfer service WorldFirst. The acquisition of WorldFirst is estimated at $ 700 million.