Customers increasingly want to pay for their purchases by card, even if it is coffee-to-go. How to provide them with this opportunity?

The PaySpace Magazine editors figured out which Ukrainian startups, banks and payment systems have already offered entrepreneurs an alternative to POS terminals. After all, the idea of accepting payments from a smartphone is not new in the domestic market. Over the past few years, several alternative card acceptance services have appeared on the market. Some use NFC technology, others use QR codes. In addition, there are mini-terminals on the market for accepting payments.

This year, the most popular solutions for accepting payments offline are participating in the PaySpace Magazine Awards 2021. You can vote for the best service by following the link:

Mobile applications

The merchant installs a mobile application on his smartphone that allows him to accept payments from consumer bank cards

Visa Tap to phone

To accept non-cash payment (from a customer's card or mobile wallet), a merchant only needs to have a smartphone with NFC on Android OS. And a dedicated mobile app. And to the buyer - a contactless card or mobile wallet. The project was launched by the Visa payment system and Oschadbank.

Unlike traditional POS, the client does not have to pay 300 UAH monthly for the terminal rental. At the same time, the fees for accepting payments (% of the transaction) will not differ from the current rates of the bank. After all, Tap to phone is based on the standard acquiring model.

If a client pays for a purchase over UAH 1000 with a card, the application will prompt him to enter his PIN on the screen of the seller's device. If the payment will be made from a mobile wallet? There is no need to confirm the transaction, because the client has already done this when unlocking the phone.

FONDY

The FONDY payment platform launched a service for accepting payments using an NFC smartphone back in 2017.

Technologically, Visa and FONDY solutions differ - the latter works according to the CNP model. That is, the transaction takes place according to the same model as in e-commerce. However, in the case of this application, the NFC reader allows you to read the physical card data that the customer usually enters when purchasing from an online store. And use them to make a payment.

But the process of making a payment for the end user remains simple and convenient.

I believe that the active development of Tap to Phone, coupled with advertising support and promotion from Visa, will give the technology a second chance and make it popular among small and medium-sized businesses.

Among the advantages of using this payment method, the FONDY expert calls the absence of the need to purchase POS terminals, a new level of comfort for the consumer and an increase in the financial involvement of the population in Ukraine.

The absence of the need to purchase POS terminals and maintain them can have a positive effect on many areas and, most importantly, open up opportunities for making quick cashless payments where they did not exist before - in markets, at exhibitions, events in small bakeries, barbershops and many other places where we are used to cash payments.

The disadvantage of the service for accepting NFC payments, common for the Visa and FONDY services, is the restriction on accepting payments using the iPhone. NFC is not available to app developers on Apple devices.

It is possible to connect the FONDY service for accepting payments from a smartphone by individual agreement, after registration and approval of a client project for cooperation.

A similar functionality was presented in Tachcard two years ago .

We will not delve into the technology, but our payments were processed as a MOTO (CNP) transaction, Visa payments were made using the acquiring / merchant acquiring protocol.

The solution is disabled today. The company explained that they are developing products for the customer.

FacePay (PrivatBank)

FacePay is a payment technology developed by PrivatBank and Visa payment system. The service is based on recognition of buyers' faces.

How it works: the client in the updated Privat24 adds 3 photos and chooses the card with which he plans to make payments. In the store, the cashier chooses the payment method - FacePay, the client takes a photo on the tablet near the cash register, the bank identifies the client, determines the card for debiting the funds and returns the status of a successful transaction to the cashier.

Shake to pay (monobank)

This service is not intended to accept payments on an ongoing basis. However, waiters and small merchants sometimes use it to accept payment if the customer does not have cash.

To transfer money to someone who is nearby, you must simultaneously shake your phones. The gadgets recognize each other via Bluetooth: the contacts of both participants in the translation will be displayed on the application screen.

A prerequisite is that the seller and buyers must use the monobank application. At the same time, transfers between Monobank cards are free.

QR codes

Special chat bots will help you accept payment in the messenger by encrypting the merchant's payment data into a QR code

PayLastic

Ukrainian startup PayLastic offers a solution for contactless payment for goods and services by bank cards through chat bots in Telegram, Viber and Facebook messengers. This does not require terminals or separate mobile apps. And the connection takes a few minutes. Moreover, the peculiarity of the service is that the buyer can scan the code using a regular program for recognizing bar / QR codes.

To generate a check with a payment QR code, the seller needs to open a chat bot in one of the messengers and select the "Create check" option and specify the amount to be paid. The buyer will proceed to checkout by scanning this code using a regular QR code reader.

The PayLastic service is available to customers of the following payment operators: Oschadbank, Fondy, Liqpay, Portmone, WayForPay. To use the resource, you need to conclude an acquiring agreement with one of these providers. The startup offers connection, setting up the service and the first month of use for free, the second month and then - $ 3.

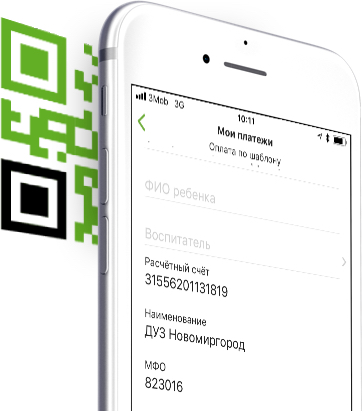

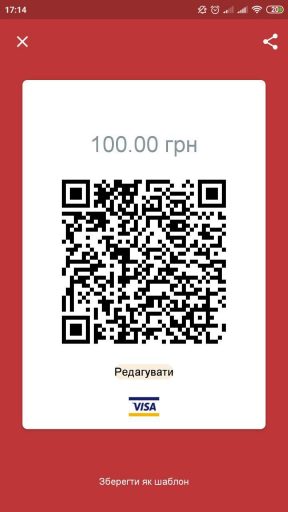

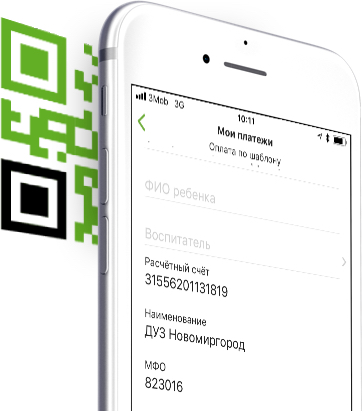

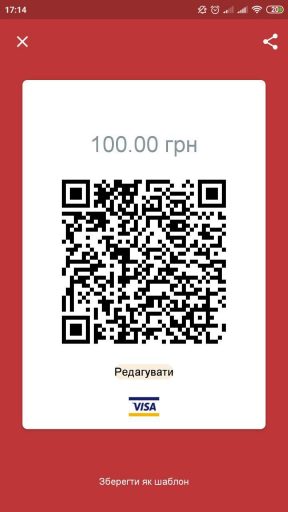

PrivatPayBot

To accept a payment using the PrivatPayBot chatbot, the seller needs to specify the payment amount, after which the bot will automatically create and display a QR code on the smartphone screen.

Unlike the previous service, the buyer will not be able to scan the code with a regular scanner. You must use the Privat24 banking application.

For commercial recipients who will accept payments via a QR code, the commission will be 2.75%.

Alfa QR MSB

Alfa QR MSB is an instrument of a mobile payment solution for business from Alfa-Bank based on the technology of QR payments from Visa.

An entrepreneur can accept payments by simply generating a QR code in the Alfa QR MSB app. And the buyer scans this QR code using his smartphone to pay with any card.

Mastercard QR

Mastercard presented solutions for accepting payments via QR last year as part of large-scale summer cashless festivals - Odessa International Film Festival and Atlas Weekend.

To sell goods via QR, the merchant generates a code with all the necessary payment data (via a telegram bot or in a special program), and the buyer pays for it from the Masterpass wallet. There are two payment models. The first is to link your Masterpass wallet to the telegram bot and send it an image of the photographed QR code.

Another payment option is using a special application of the partner service that supports the Masterpass wallet. For example, Vodafone Pay and SMART Groshi. The solution could be tested at Atlas Weekend 2021 by scanning the code from the seller's tablet, the buyer could choose one of the cards to pay in his Masterpass wallet.

Today, offline merchants can connect to the service of accepting payments by QR by contacting Mastercard or partners who are direct service providers - iPay.ua, TAS LINK or UPC (Ukrainian Processing Center).

Mobile POS terminals

mPOS terminals are devices that connect to a smartphone via the headphone jack or via Bluetooth. And they allow you to accept cards for payment. They can be used wherever mobile internet is available.

MOSST Reader

MOSST launched mPOS terminals on sale in the spring of 2021. Small devices connect to a smartphone via Bluetooth and allow you to accept chip and contactless cards at any point of sale from a smartphone on Android or iOS

To use the service, the client must apply for a card reader, providing the company with a copy of the passport, identification code and certificate of registration of the sole proprietor. After processing the application, the client will receive an mPOS terminal and a mobile application, which will become the main interface for receiving and accounting for payments.

It is in the application that the merchant will drive in the purchase amount for further payment through the card reader.

Funds are credited to an account opened in any bank. The funds, minus the MOSST commission, are received on the third banking day from the date of payment.

Commission for accepting payments - 2.75% of the amount of each transaction.

miniPOS

PrivatBank launched the first mobile terminals back in 2011. Back then, they only handled magnetic stripe cards. In 2018, the bank updated its technology by introducing a gadget capable of accepting payments with a chip or contactless credit card.

Commission for accepting payments:

Smart Cashier

Smart Checkout is a universal solution for conducting retail business and organizing card payments, developed by Ukrtrimex in partnership with Mastercard and Vodafone.

The gadget processes all types of non-cash and cash payments, and also accepts payment via a QR code. The device runs on Android, and the user will be able to automate loyalty programs on it and customize them to suit the needs of their business.

As you can see, there are solutions that simplify the acceptance of cards for payment: street food sellers, coffee machine owners, handmade craftsmen, flower kiosks, car services, farm shops, etc. can process non-cash payments.

The PaySpace Magazine editors figured out which Ukrainian startups, banks and payment systems have already offered entrepreneurs an alternative to POS terminals. After all, the idea of accepting payments from a smartphone is not new in the domestic market. Over the past few years, several alternative card acceptance services have appeared on the market. Some use NFC technology, others use QR codes. In addition, there are mini-terminals on the market for accepting payments.

This year, the most popular solutions for accepting payments offline are participating in the PaySpace Magazine Awards 2021. You can vote for the best service by following the link:

Mobile applications

The merchant installs a mobile application on his smartphone that allows him to accept payments from consumer bank cards

Visa Tap to phone

To accept non-cash payment (from a customer's card or mobile wallet), a merchant only needs to have a smartphone with NFC on Android OS. And a dedicated mobile app. And to the buyer - a contactless card or mobile wallet. The project was launched by the Visa payment system and Oschadbank.

Unlike traditional POS, the client does not have to pay 300 UAH monthly for the terminal rental. At the same time, the fees for accepting payments (% of the transaction) will not differ from the current rates of the bank. After all, Tap to phone is based on the standard acquiring model.

If a client pays for a purchase over UAH 1000 with a card, the application will prompt him to enter his PIN on the screen of the seller's device. If the payment will be made from a mobile wallet? There is no need to confirm the transaction, because the client has already done this when unlocking the phone.

FONDY

The FONDY payment platform launched a service for accepting payments using an NFC smartphone back in 2017.

Technologically, Visa and FONDY solutions differ - the latter works according to the CNP model. That is, the transaction takes place according to the same model as in e-commerce. However, in the case of this application, the NFC reader allows you to read the physical card data that the customer usually enters when purchasing from an online store. And use them to make a payment.

But the process of making a payment for the end user remains simple and convenient.

I believe that the active development of Tap to Phone, coupled with advertising support and promotion from Visa, will give the technology a second chance and make it popular among small and medium-sized businesses.

Among the advantages of using this payment method, the FONDY expert calls the absence of the need to purchase POS terminals, a new level of comfort for the consumer and an increase in the financial involvement of the population in Ukraine.

The absence of the need to purchase POS terminals and maintain them can have a positive effect on many areas and, most importantly, open up opportunities for making quick cashless payments where they did not exist before - in markets, at exhibitions, events in small bakeries, barbershops and many other places where we are used to cash payments.

The disadvantage of the service for accepting NFC payments, common for the Visa and FONDY services, is the restriction on accepting payments using the iPhone. NFC is not available to app developers on Apple devices.

It is possible to connect the FONDY service for accepting payments from a smartphone by individual agreement, after registration and approval of a client project for cooperation.

A similar functionality was presented in Tachcard two years ago .

We will not delve into the technology, but our payments were processed as a MOTO (CNP) transaction, Visa payments were made using the acquiring / merchant acquiring protocol.

The solution is disabled today. The company explained that they are developing products for the customer.

FacePay (PrivatBank)

FacePay is a payment technology developed by PrivatBank and Visa payment system. The service is based on recognition of buyers' faces.

How it works: the client in the updated Privat24 adds 3 photos and chooses the card with which he plans to make payments. In the store, the cashier chooses the payment method - FacePay, the client takes a photo on the tablet near the cash register, the bank identifies the client, determines the card for debiting the funds and returns the status of a successful transaction to the cashier.

Shake to pay (monobank)

This service is not intended to accept payments on an ongoing basis. However, waiters and small merchants sometimes use it to accept payment if the customer does not have cash.

To transfer money to someone who is nearby, you must simultaneously shake your phones. The gadgets recognize each other via Bluetooth: the contacts of both participants in the translation will be displayed on the application screen.

A prerequisite is that the seller and buyers must use the monobank application. At the same time, transfers between Monobank cards are free.

QR codes

Special chat bots will help you accept payment in the messenger by encrypting the merchant's payment data into a QR code

PayLastic

Ukrainian startup PayLastic offers a solution for contactless payment for goods and services by bank cards through chat bots in Telegram, Viber and Facebook messengers. This does not require terminals or separate mobile apps. And the connection takes a few minutes. Moreover, the peculiarity of the service is that the buyer can scan the code using a regular program for recognizing bar / QR codes.

To generate a check with a payment QR code, the seller needs to open a chat bot in one of the messengers and select the "Create check" option and specify the amount to be paid. The buyer will proceed to checkout by scanning this code using a regular QR code reader.

The PayLastic service is available to customers of the following payment operators: Oschadbank, Fondy, Liqpay, Portmone, WayForPay. To use the resource, you need to conclude an acquiring agreement with one of these providers. The startup offers connection, setting up the service and the first month of use for free, the second month and then - $ 3.

PrivatPayBot

To accept a payment using the PrivatPayBot chatbot, the seller needs to specify the payment amount, after which the bot will automatically create and display a QR code on the smartphone screen.

Unlike the previous service, the buyer will not be able to scan the code with a regular scanner. You must use the Privat24 banking application.

For commercial recipients who will accept payments via a QR code, the commission will be 2.75%.

Alfa QR MSB

Alfa QR MSB is an instrument of a mobile payment solution for business from Alfa-Bank based on the technology of QR payments from Visa.

An entrepreneur can accept payments by simply generating a QR code in the Alfa QR MSB app. And the buyer scans this QR code using his smartphone to pay with any card.

Mastercard QR

Mastercard presented solutions for accepting payments via QR last year as part of large-scale summer cashless festivals - Odessa International Film Festival and Atlas Weekend.

To sell goods via QR, the merchant generates a code with all the necessary payment data (via a telegram bot or in a special program), and the buyer pays for it from the Masterpass wallet. There are two payment models. The first is to link your Masterpass wallet to the telegram bot and send it an image of the photographed QR code.

Another payment option is using a special application of the partner service that supports the Masterpass wallet. For example, Vodafone Pay and SMART Groshi. The solution could be tested at Atlas Weekend 2021 by scanning the code from the seller's tablet, the buyer could choose one of the cards to pay in his Masterpass wallet.

Today, offline merchants can connect to the service of accepting payments by QR by contacting Mastercard or partners who are direct service providers - iPay.ua, TAS LINK or UPC (Ukrainian Processing Center).

Mobile POS terminals

mPOS terminals are devices that connect to a smartphone via the headphone jack or via Bluetooth. And they allow you to accept cards for payment. They can be used wherever mobile internet is available.

MOSST Reader

MOSST launched mPOS terminals on sale in the spring of 2021. Small devices connect to a smartphone via Bluetooth and allow you to accept chip and contactless cards at any point of sale from a smartphone on Android or iOS

To use the service, the client must apply for a card reader, providing the company with a copy of the passport, identification code and certificate of registration of the sole proprietor. After processing the application, the client will receive an mPOS terminal and a mobile application, which will become the main interface for receiving and accounting for payments.

It is in the application that the merchant will drive in the purchase amount for further payment through the card reader.

Funds are credited to an account opened in any bank. The funds, minus the MOSST commission, are received on the third banking day from the date of payment.

Commission for accepting payments - 2.75% of the amount of each transaction.

miniPOS

PrivatBank launched the first mobile terminals back in 2011. Back then, they only handled magnetic stripe cards. In 2018, the bank updated its technology by introducing a gadget capable of accepting payments with a chip or contactless credit card.

Commission for accepting payments:

- 2.75% of the amount of each transaction

- or 2.75% from each transaction

Smart Cashier

Smart Checkout is a universal solution for conducting retail business and organizing card payments, developed by Ukrtrimex in partnership with Mastercard and Vodafone.

The gadget processes all types of non-cash and cash payments, and also accepts payment via a QR code. The device runs on Android, and the user will be able to automate loyalty programs on it and customize them to suit the needs of their business.

As you can see, there are solutions that simplify the acceptance of cards for payment: street food sellers, coffee machine owners, handmade craftsmen, flower kiosks, car services, farm shops, etc. can process non-cash payments.