CarderPlanet

Professional

- Messages

- 2,549

- Reaction score

- 724

- Points

- 113

Content

In 2017-2018, the international financial startup Revolut began to actively gain popularity. He offered clients multicurrency cards without extra commissions for transactions and with a large number of additional options. Although the project still does not work officially in Russia, it was able to interest our fellow citizens as well.

#VseLoansOnline decided to study the Revolut project and the cards it offers in order to assess how difficult it is to get them and how convenient they are for the holder. In this article, you will learn more about the cards of the international banking service. We will tell you why they are remarkable, how to arrange them.

Convenience

At the standard tariff, the card is serviced completely free of charge

Conditions

You can transfer money in a large number of currencies without commission

Reliability

Revolut operates on the basis of a number of large European banks

Availability

To apply for a card, you need to live in the country where the service is present

Advantages:

At the standard rate, the card is serviced free of charge. At the same time, all the basic options are still available for it.

The card is drawn up online with delivery by mail in the countries where the service is present. There is no need to contact departments or meet with field specialists.

You can transfer money in 30 currencies without commission and pay in 150 currencies. Additional charges may apply only on weekends or international transfers.

You can turn off some payment methods or set location control. This provides additional security for payments.

Flaws:

To obtain a card, you need citizenship, a residence permit or a long-term visa in the country where the service is present. Delivery is also limited to the countries of presence.

You can deposit money to the card only by wire transfer. You can only withdraw cash from ATMs.

Scheduled or emergency re-releases are made in the country of issue. A commission is charged for an unscheduled reissue.

Subsequently, other offers for individuals and businesses were launched on the basis of Revolut. Among them are settlement and cash services, investment and cryptocurrency instruments, services for financial planning and many others. By 2021, the service has been launched in more than 35 countries, including the US, Japan, Australia and the EU. Almost everywhere where a project is present, the available services are provided on approximately the same terms.

However, the project is still not officially present in Russia. It was planned to bring it to our market in 2018-2019 in partnership with Qiwi-Bank . But later these plans had to be abandoned. The reasons for this decision are still not clear, but most likely they are associated with the insufficient stability of the Russian market, the distrust of foreign investors in it, the difficulties of interactions between Russian and foreign banks, and the tense political environment.

In addition, we already have quite strong competitors offering a similar service - among them, including Tinkoff .

Also, the card can work with cryptocurrencies, but this functionality is not available in all countries. Bitcoin, Ethereum, Litecoin, Ripple and some other popular cryptocurrencies are supported.

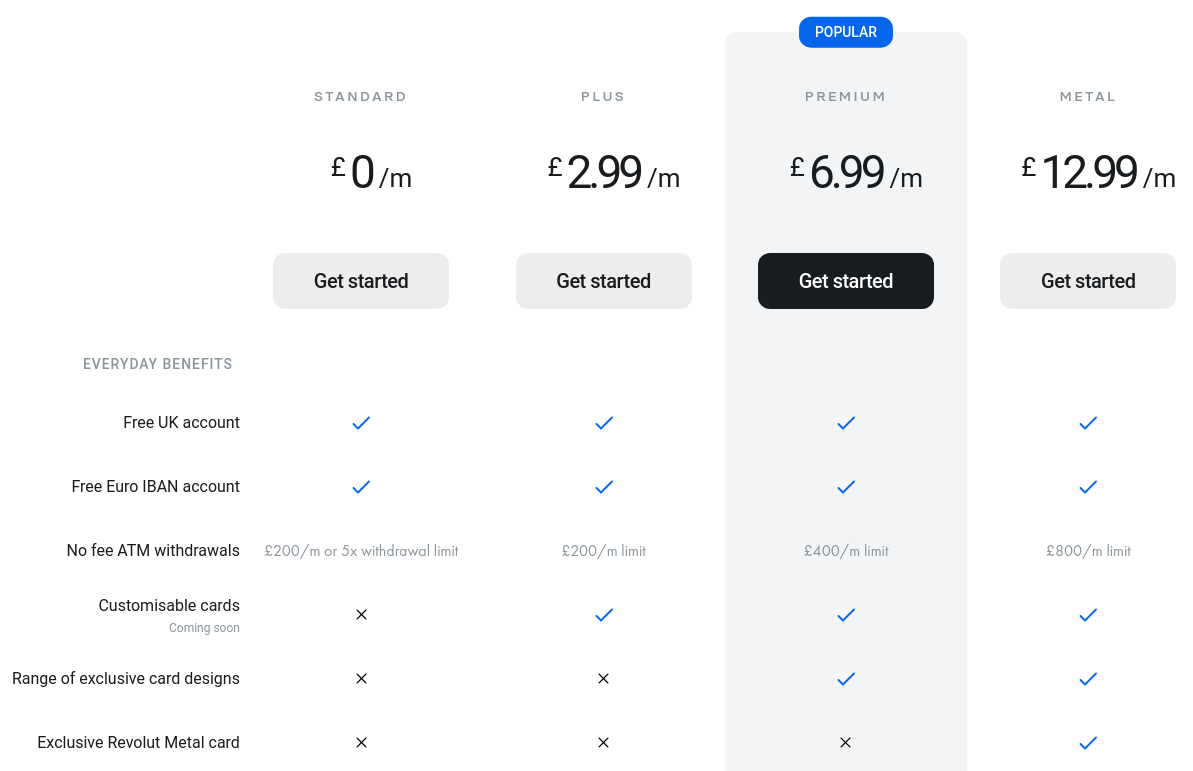

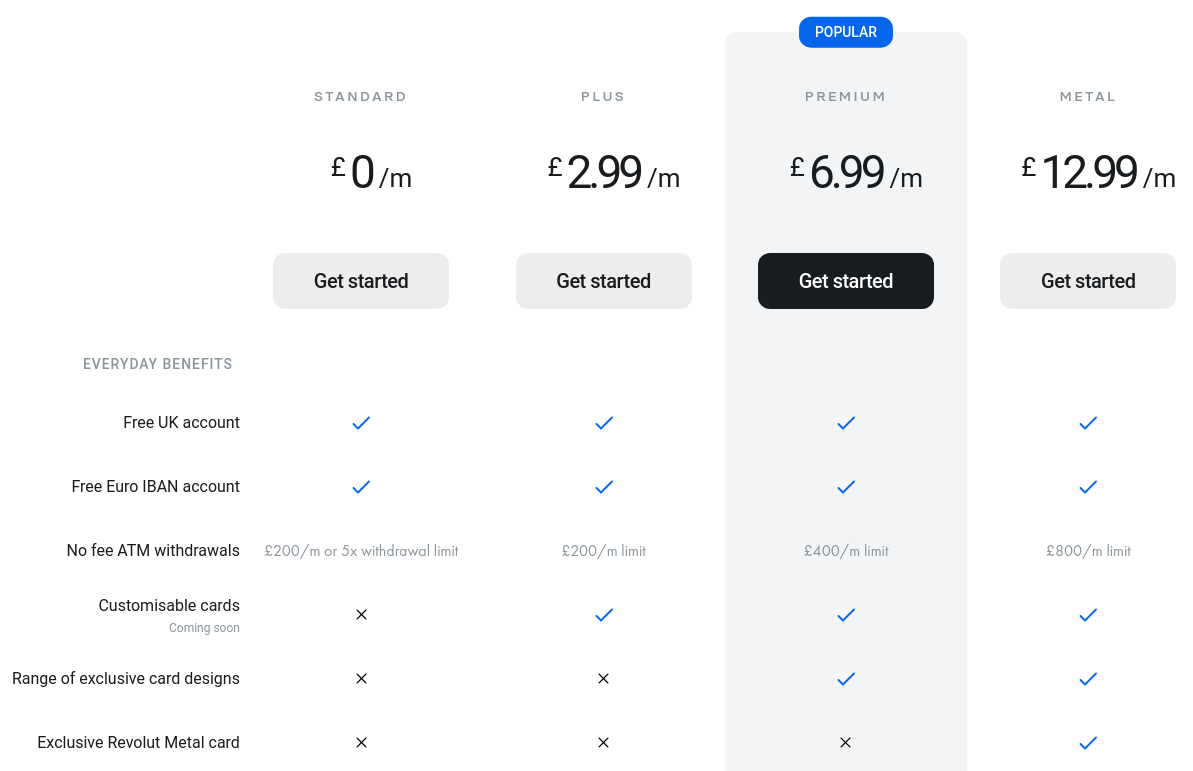

The card is issued in the Visa or MasterCard system. The holder has four tariff plans available - Standard, Plus, Premium and Metal. They differ from each other in the cost of service, additional services and limits for individual operations, other conditions and functionality remain the same.

The main conditions and tariffs of the card are in the table:

You can apply in the mobile application. To do this, install it on your device, enter your phone number and set the PIN-code that will be used to confirm transactions.

Next, enter your personal and passport data, and upload a scanned copy of your passport and a document confirming the right to reside in the country to confirm your identity. After successfully confirming your identity, you will need to activate the account - for this you need to transfer a small amount to it within the range of 5-10 pounds.

Immediately after registration, a virtual card will be available - you can use it online or link it to your smartphone. You can also release a plastic version - for this you will need to additionally indicate the receiving address. The finished card will be delivered by mail within 1-10 business days to the office or to the address of residence, a delivery fee of £ 4.99 will be charged depending on the country of receipt.

Switching between currency accounts and transfers between them are made in the application. 30 currencies are available for settlements and exchange, including US dollars, euros, pounds sterling, yen and Swiss francs. You can replenish any of the accounts in cash or from another card, including from a third-party bank. It is advisable to deposit money in the account currency to avoid additional conversion. Auto payments and request for money from other clients of the service are available. Additional fees may apply for transfers to countries where the service is not available.

When paying for purchases and withdrawing cash in a currency other than the account currency, the exchange is made at the interbank rate. For almost all currencies from the main list, commissions are not charged. At the same time, on weekends (taken into account London time), increments of 0.5-1% are established for maintaining the exchange rate. You can withdraw money at any ATM, but cash replenishment is not available.

For transactions in hryvnia and Thai baht, an additional commission is taken (1% and 1.5%, respectively). They add up with weekend surcharges.

Up to three plastic and up to five virtual cards can be issued simultaneously for one client. Re-issue of a plastic card in case of loss, theft or compromise of the card, the re-issue will cost 5 pounds, scheduled - free of charge. Delivery is paid separately depending on the tariff and region. Issuance and closing of virtual cards are free of charge.

The disadvantages of the card are mostly related to the fact that the service is not officially present:

Such a card is suitable for those who often make foreign currency payments - for example, travelers who work with foreign companies or who move to the countries where the service is present. It is easier to get it than at a local bank, and the conditions will be more favorable than with Russian cards. In all other cases, it becomes unprofitable, and instead it is better to use a similar offer from one of the Russian banks.

Revolut is an international banking service offering multicurrency cards and additional services for them. Its offer is distinguished by the following features:

- Map overview

- What is the Revolut project?

- What the Revolut card offers

- How to get a Revolut card Using the card

- Advantages and disadvantages

- Conclusion

- Sources of

In 2017-2018, the international financial startup Revolut began to actively gain popularity. He offered clients multicurrency cards without extra commissions for transactions and with a large number of additional options. Although the project still does not work officially in Russia, it was able to interest our fellow citizens as well.

#VseLoansOnline decided to study the Revolut project and the cards it offers in order to assess how difficult it is to get them and how convenient they are for the holder. In this article, you will learn more about the cards of the international banking service. We will tell you why they are remarkable, how to arrange them.

Map overview

Convenience

At the standard tariff, the card is serviced completely free of charge

Conditions

You can transfer money in a large number of currencies without commission

Reliability

Revolut operates on the basis of a number of large European banks

Availability

To apply for a card, you need to live in the country where the service is present

Advantages:

At the standard rate, the card is serviced free of charge. At the same time, all the basic options are still available for it.

The card is drawn up online with delivery by mail in the countries where the service is present. There is no need to contact departments or meet with field specialists.

You can transfer money in 30 currencies without commission and pay in 150 currencies. Additional charges may apply only on weekends or international transfers.

You can turn off some payment methods or set location control. This provides additional security for payments.

Flaws:

To obtain a card, you need citizenship, a residence permit or a long-term visa in the country where the service is present. Delivery is also limited to the countries of presence.

You can deposit money to the card only by wire transfer. You can only withdraw cash from ATMs.

Scheduled or emergency re-releases are made in the country of issue. A commission is charged for an unscheduled reissue.

What is the Revolut project?

Fintech project Revolut was launched in 2014 in the UK. It was founded by Russian Nikolai Storonsky and Ukrainian Vlad Yatsenko. The idea of the project is to offer a convenient tool for settlements around the world with minimal restrictions and commissions, and with management through online services.

Subsequently, other offers for individuals and businesses were launched on the basis of Revolut. Among them are settlement and cash services, investment and cryptocurrency instruments, services for financial planning and many others. By 2021, the service has been launched in more than 35 countries, including the US, Japan, Australia and the EU. Almost everywhere where a project is present, the available services are provided on approximately the same terms.

However, the project is still not officially present in Russia. It was planned to bring it to our market in 2018-2019 in partnership with Qiwi-Bank . But later these plans had to be abandoned. The reasons for this decision are still not clear, but most likely they are associated with the insufficient stability of the Russian market, the distrust of foreign investors in it, the difficulties of interactions between Russian and foreign banks, and the tense political environment.

In addition, we already have quite strong competitors offering a similar service - among them, including Tinkoff .

What the Revolut card offers

The main product of the Revolut service since its inception has been a multicurrency payment card. It allows almost no commission to instantly transfer money in 30 currencies and pay for purchases and withdraw cash in 150 currencies (including rubles, US dollars, euros and pounds sterling). All transactions are carried out at the interbank exchange rate - in the aggregate, this helps to save on settlements.

Also, the card can work with cryptocurrencies, but this functionality is not available in all countries. Bitcoin, Ethereum, Litecoin, Ripple and some other popular cryptocurrencies are supported.

The card is issued in the Visa or MasterCard system. The holder has four tariff plans available - Standard, Plus, Premium and Metal. They differ from each other in the cost of service, additional services and limits for individual operations, other conditions and functionality remain the same.

The main conditions and tariffs of the card are in the table:

| Rate | Standard | Plus | Premium | Metal |

| Service | Is free | 2.99 lb (equivalent) per month | £ 6.99 (equivalent) per month | £ 12.99 (equivalent) per month |

| Currency exchange limit | 1,000 pounds (equivalent) per month, over the limit - commission 0.5% | Missing | ||

| Replenishment | Transfer from another card - free of charge (commission of the sending bank may be charged) | |||

| Cash withdrawal | £ 200 (equivalent) per month - no commission, then 2% | 440 pounds (equivalent) per month - no commission, then 2% | £ 800 (equivalent) per month - no commission, then 2% | |

| Transfers to other banks | 2% for all transfers | 2% for all transfers |

|

|

| Bonuses | Not |

| ||

| Additionally | Free Junior rate for one child |

|

|

|

How to get a Revolut card

The card is issued completely online with delivery by mail. Revolut has no branches or field specialists; all interaction with clients is carried out remotely. At the same time, cards are not delivered to Russia, therefore, citizenship, a residence permit or a long-term visa in the country where the service is present, as well as, preferably, a phone number from one of the local operators, are required for registration.You can apply in the mobile application. To do this, install it on your device, enter your phone number and set the PIN-code that will be used to confirm transactions.

Next, enter your personal and passport data, and upload a scanned copy of your passport and a document confirming the right to reside in the country to confirm your identity. After successfully confirming your identity, you will need to activate the account - for this you need to transfer a small amount to it within the range of 5-10 pounds.

Immediately after registration, a virtual card will be available - you can use it online or link it to your smartphone. You can also release a plastic version - for this you will need to additionally indicate the receiving address. The finished card will be delivered by mail within 1-10 business days to the office or to the address of residence, a delivery fee of £ 4.99 will be charged depending on the country of receipt.

Using the card

The card is managed in the Internet bank and mobile application (the latter has versions for iOS and Android. They provide all the necessary functionality for making payments and controlling transactions. Security settings, in addition to setting limits or restrictions, include additional options - disabling contactless payments or magnetic stripe, location control and others.Switching between currency accounts and transfers between them are made in the application. 30 currencies are available for settlements and exchange, including US dollars, euros, pounds sterling, yen and Swiss francs. You can replenish any of the accounts in cash or from another card, including from a third-party bank. It is advisable to deposit money in the account currency to avoid additional conversion. Auto payments and request for money from other clients of the service are available. Additional fees may apply for transfers to countries where the service is not available.

When paying for purchases and withdrawing cash in a currency other than the account currency, the exchange is made at the interbank rate. For almost all currencies from the main list, commissions are not charged. At the same time, on weekends (taken into account London time), increments of 0.5-1% are established for maintaining the exchange rate. You can withdraw money at any ATM, but cash replenishment is not available.

For transactions in hryvnia and Thai baht, an additional commission is taken (1% and 1.5%, respectively). They add up with weekend surcharges.

Up to three plastic and up to five virtual cards can be issued simultaneously for one client. Re-issue of a plastic card in case of loss, theft or compromise of the card, the re-issue will cost 5 pounds, scheduled - free of charge. Delivery is paid separately depending on the tariff and region. Issuance and closing of virtual cards are free of charge.

Advantages and disadvantages

In general, the Revolut card looks comfortable enough for active use. This is facilitated by the following advantages:- Foreign currency accounts and transfers without commission are already available on a free plan

- No extra commissions are charged for replenishment and currency exchange - this is convenient for those who actively use different currencies

- At any tariff, virtual cards are available that support contactless payment via NFC

- Registration and processing of the card is faster, and the requirements for the client are less stringent than in other European banks

- Advanced security settings available, including disabling certain features and controlling location

- The application has been translated into a large number of languages, including Russian - it is quite easy to understand it

The disadvantages of the card are mostly related to the fact that the service is not officially present:

- It is quite difficult to issue a card - you will need to live in the country where the service is present for a long time. However, for this it is enough to have a long-term visa or residence permit.

- If problems arise (for example, account blocking or legal disputes), the proceedings will take place in a foreign jurisdiction - most likely in the British or European. The Central Bank and other Russian authorities will not help you here.

- For a planned re-issue of the card or its replacement in case of loss or theft, you will need to return to the country of issue. Even with a visa or residence permit, this will lead to additional costs

- You will not be able to replenish the card in cash - you will have to transfer money to it from other cards and accounts. When making a transfer, the bank from which the payment is sent may charge its own commission

Conclusion

The Revolut project turned out to be quite successful and attractive, especially against the background of generally quite conservative European banks. He was able to offer users a multicurrency card with convenient conditions and other financial services managed in the application. However, they can be used comfortably only in countries where Revolut works officially.Such a card is suitable for those who often make foreign currency payments - for example, travelers who work with foreign companies or who move to the countries where the service is present. It is easier to get it than at a local bank, and the conditions will be more favorable than with Russian cards. In all other cases, it becomes unprofitable, and instead it is better to use a similar offer from one of the Russian banks.

Revolut is an international banking service offering multicurrency cards and additional services for them. Its offer is distinguished by the following features:

- The card allows you to transfer money in 30 currencies without commissions and pay for purchases in 150 currencies

- The standard tariff is serviced free of charge, all basic services are available on it

- The card is controlled in a mobile application, it has a plastic and a virtual version with support for contactless payment

- Application functionality includes payments, transfers and currency exchange, advanced settings and access to additional services

- In Russia, the service has not been officially launched; to issue a card, you must live in one of the countries of presence